An Investment Policy Statement (IPS) is a crucial document that serves as a roadmap for investors and their financial advisors.

It outlines the investor’s goals, risk tolerance, and investment strategy, providing a clear framework for making informed investment decisions.

As financial markets evolve and personal circumstances change, having a well-crafted IPS becomes increasingly important for maintaining a disciplined and effective approach to wealth management.

Understanding The Basics Of An Investment Policy Statement

An Investment Policy Statement is a comprehensive document that defines the parameters and guidelines for managing an investment portfolio.

It serves as a strategic planning tool, helping investors and their advisors navigate the complex world of financial markets while staying focused on long-term objectives.

Definition And Purpose Of An IPS

An Investment Policy Statement (IPS) is a formal document that outlines an investor’s goals, risk tolerance, time horizon, and overall investment strategy.

Its primary purpose is to provide a clear framework for making investment decisions and managing a portfolio over time.

The IPS acts as a roadmap, guiding investors and their financial advisors through various market conditions and helping them stay focused on long-term objectives.

The IPS serves multiple purposes:

- Clarity: It clearly defines the investor’s goals, expectations, and constraints, ensuring that both the investor and advisor are on the same page.

- Consistency: By establishing guidelines, the IPS promotes consistency in decision-making, reducing the likelihood of emotional or impulsive choices.

- Accountability: The document sets benchmarks and performance metrics, allowing for regular evaluation of the portfolio’s progress.

- Communication: It facilitates effective communication between the investor and advisor, providing a shared reference point for discussions about the portfolio.

- Compliance: For institutional investors, an IPS can help demonstrate adherence to fiduciary responsibilities and regulatory requirements.

Key Components Of An Investment Policy Statement

A comprehensive Investment Policy Statement typically includes several key components:

- Investor Profile: This section outlines the investor’s personal information, financial situation, and investment experience. It may include details such as age, income, net worth, and any unique circumstances that may impact investment decisions.

- Investment Objectives: Here, the specific financial goals of the investor are clearly stated. These might include retirement planning, funding education, wealth accumulation, or generating income. Each objective should be quantifiable and have an associated time horizon.

- Risk Tolerance: This crucial component assesses the investor’s ability and willingness to accept investment risk. It considers factors such as the investor’s emotional capacity to withstand market volatility and their financial capacity to absorb potential losses.

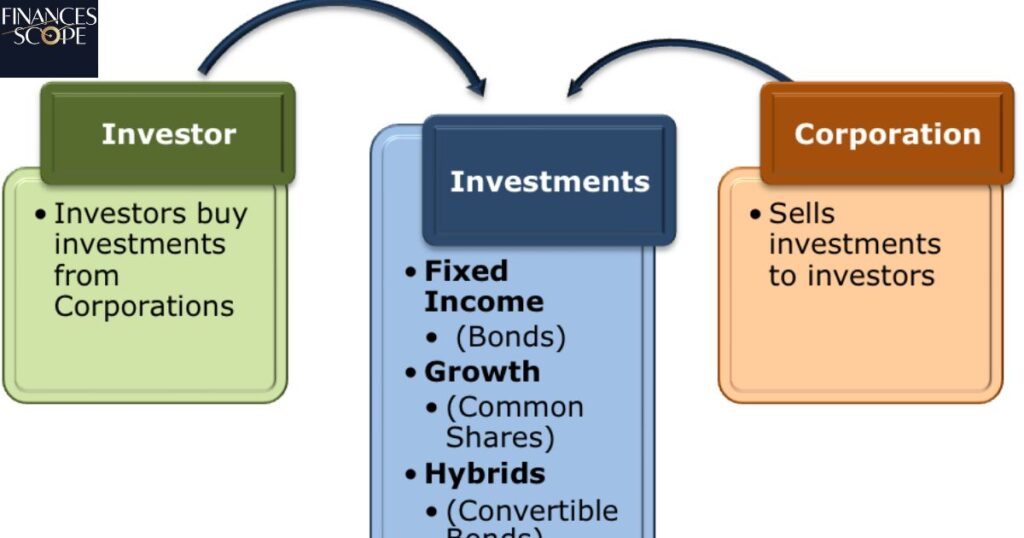

- Asset Allocation Strategy: Based on the investor’s objectives and risk tolerance, this section outlines the target allocation of assets across different classes (e.g., stocks, bonds, real estate, cash). It may also include sub-allocations within each asset class.

- Investment Selection Criteria: This component defines the parameters for selecting specific investments. It may include criteria such as investment style (e.g., value vs. growth), market capitalization, geographic focus, or sector preferences.

- Rebalancing Guidelines: The IPS should specify how often the portfolio will be reviewed and rebalanced to maintain the target asset allocation. This might include specific triggers, such as when an asset class deviates from its target by a certain percentage.

- Performance Measurement: This section outlines how investment performance will be evaluated. It typically includes benchmark indices for each asset class and the overall portfolio, as well as the frequency of performance reviews.

- Constraints and Restrictions: Any specific limitations on investments should be clearly stated. This might include restrictions on certain types of securities, minimum credit ratings for fixed income investments, or maximum allocations to any single security.

Read This Blog: Is VOO A Good Investment?

The Process Of Creating An Investment Policy Statement

Creating an effective Investment Policy Statement involves several steps:

- Gather Information: The process begins with collecting comprehensive information about the investor’s financial situation, goals, and risk tolerance. This often involves in-depth discussions and may include questionnaires or risk assessment tools.

- Define Objectives: Based on the gathered information, clear and specific investment objectives are established. These should be measurable and have defined time horizons.

- Assess Risk Tolerance: A thorough evaluation of the investor’s risk tolerance is conducted, considering both their emotional comfort with risk and their financial capacity to withstand potential losses.

- Develop Asset Allocation: Using the defined objectives and risk tolerance, an appropriate asset allocation strategy is developed. This involves determining the optimal mix of asset classes to achieve the investor’s goals while staying within their risk parameters.

- Establish Investment Criteria: Specific criteria for selecting investments within each asset class are defined. This might include factors such as investment style, market capitalization, or geographic focus.

- Set Performance Benchmarks: Appropriate benchmarks are selected for each asset class and the overall portfolio to measure investment performance.

- Define Monitoring and Rebalancing Procedures: Guidelines for regularly reviewing the portfolio and rebalancing to maintain the target asset allocation are established.

- Review and Approve: The draft IPS is reviewed with the investor to ensure it accurately reflects their goals and preferences. Any necessary adjustments are made before final approval.

- Implement and Monitor: Once approved, the investment strategy outlined in the IPS is implemented. Regular reviews are conducted to ensure adherence to the IPS and to assess progress toward the defined objectives.

The Importance Of An Investment Policy Statement

An Investment Policy Statement plays a crucial role in effective portfolio management and helps investors achieve their financial goals.

Understanding its importance can lead to better investment outcomes and a more disciplined approach to wealth management.

Providing Clarity And Direction

One of the primary benefits of an Investment Policy Statement is the clarity it provides. By clearly articulating investment goals, risk tolerance, and strategy, the IPS serves as a guiding light for all investment decisions.

This clarity is particularly valuable during times of market volatility or when faced with complex investment choices.

The IPS helps investors and their advisors maintain a long-term perspective, avoiding the pitfalls of short-term thinking or emotional reactions to market fluctuations.

It provides a structured framework for decision-making, ensuring that all investment choices align with the overall strategy and objectives.

Moreover, the process of creating an IPS forces investors to think deeply about their financial goals and risk tolerance.

This self-reflection can lead to more realistic expectations and a better understanding of the trade-offs involved in investing.

Enhancing Communication Between Investors And Advisors

An Investment Policy Statement serves as a powerful communication tool between investors and their financial advisors.

It establishes a common language and shared understanding of the investor’s goals, risk tolerance, and investment strategy.

This shared framework facilitates more productive discussions about portfolio performance and potential adjustments. When market conditions change or new investment opportunities arise, the IPS provides a reference point for evaluating these in the context of the overall strategy.

For investors working with multiple advisors or transitioning between advisors, the IPS ensures continuity in the investment approach.

It allows new advisors to quickly understand the investor’s needs and preferences, leading to a smoother transition and more consistent management of the portfolio.

Promoting Discipline And Consistency

One of the most significant benefits of an Investment Policy Statement is its role in promoting investment discipline.

By establishing clear guidelines and procedures, the IPS helps investors resist the temptation to make impulsive decisions based on short-term market movements or emotional reactions.

This discipline is particularly valuable during periods of market volatility. When markets are turbulent, the IPS serves as a reminder of the long-term strategy and helps investors stay the course rather than making knee-jerk reactions that could harm their long-term financial health.

The IPS also promotes consistency in decision-making over time. As market conditions and personal circumstances change, the IPS provides a stable framework for evaluating new opportunities or potential portfolio adjustments.

This consistency can lead to better long-term investment outcomes and help investors avoid common pitfalls such as chasing performance or timing the market.

Facilitating Performance Evaluation

An effective Investment Policy Statement includes clear benchmarks and performance metrics for evaluating the portfolio’s progress.

This facilitates regular and objective assessment of investment performance, allowing investors and advisors to identify areas of strength and weakness in the portfolio.

By establishing these benchmarks in advance, the IPS helps set realistic expectations for portfolio performance. It provides context for interpreting returns, considering factors such as market conditions and the portfolio’s risk profile.

Regular performance evaluations based on the IPS can also highlight the need for potential adjustments to the investment strategy.

If the portfolio consistently underperforms its benchmarks or if the investor’s circumstances have changed significantly, the IPS provides a framework for making thoughtful and strategic adjustments.

Legal And Fiduciary Considerations

For institutional investors, pension funds, and trustees, an Investment Policy Statement is often a legal requirement. It serves as evidence of a prudent investment process and can help demonstrate compliance with fiduciary responsibilities.

Even for individual investors, an IPS can provide legal protection by clearly documenting the agreed-upon investment strategy and decision-making process.

In the event of disputes or legal challenges, the IPS can serve as evidence of a well-thought-out and consistently applied investment approach.

Read This Blog: Is Shiba Inu A Good Investment?

Creating And Implementing An Effective IPS

Developing and implementing an effective Investment Policy Statement requires careful consideration and a systematic approach.

This process involves several key steps and considerations to ensure that the IPS serves its intended purpose.

Steps In Developing An IPS

- Gather Comprehensive Information: The first step in creating an IPS is to collect detailed information about the investor’s financial situation, goals, and preferences. This may involve in-depth discussions, questionnaires, and financial analysis.

- Define Clear Objectives: Based on the gathered information, specific and measurable investment objectives should be established. These might include targets for portfolio growth, income generation, or specific financial milestones.

- Assess Risk Tolerance: A thorough evaluation of the investor’s risk tolerance is crucial. This involves considering both their emotional comfort with market volatility and their financial capacity to withstand potential losses.

- Develop Asset Allocation Strategy: Using the defined objectives and risk tolerance, an appropriate asset allocation strategy should be developed. This involves determining the optimal mix of asset classes to achieve the investor’s goals while staying within their risk parameters.

- Establish Investment Selection Criteria: Specific criteria for selecting investments within each asset class should be defined. This might include factors such as investment style, market capitalization, or geographic focus.

- Set Performance Benchmarks: Appropriate benchmarks should be selected for each asset class and the overall portfolio to measure investment performance.

- Define Monitoring and Rebalancing Procedures: Guidelines for regularly reviewing the portfolio and rebalancing to maintain the target asset allocation should be established.

- Document Constraints and Restrictions: Any specific limitations on investments should be clearly stated in the IPS.

- Review and Approve: The draft IPS should be reviewed with the investor to ensure it accurately reflects their goals and preferences. Any necessary adjustments should be made before final approval.

Implementing The IPS

Once the Investment Policy Statement is developed and approved, the next step is implementation. This involves:

- Portfolio Construction: Building a portfolio that aligns with the asset allocation and investment selection criteria outlined in the IPS.

- Regular Monitoring: Consistently reviewing the portfolio to ensure it remains aligned with the IPS guidelines.

- Rebalancing: Periodically adjusting the portfolio to maintain the target asset allocation as defined in the IPS.

- Performance Evaluation: Regularly assessing the portfolio’s performance against the established benchmarks.

- Ongoing Communication: Maintaining open communication between the investor and advisor to discuss portfolio performance and any potential need for adjustments to the IPS.

Reviewing And Updating The IPS

An Investment Policy Statement is not a static document. It should be reviewed regularly and updated as needed to reflect changes in the investor’s circumstances, goals, or market conditions. Typically, an annual review of the IPS is recommended, with more frequent reviews if significant life events or major market shifts occur.

During these reviews, consider:

- Changes in Personal Circumstances: Have there been significant changes in the investor’s financial situation, family status, or career that might impact their investment strategy?

- Shifting Goals: Have the investor’s financial goals changed or evolved?

- Risk Tolerance Adjustments: Has the investor’s attitude toward risk or capacity to take risk changed?

- Market Conditions: Have there been significant changes in the investment landscape that might warrant adjustments to the strategy?

- Performance Evaluation: Is the portfolio meeting its performance objectives? If not, are adjustments needed to the strategy or benchmarks?

Frequently Asked Questions

What is the ideal length for an Investment Policy Statement?

An effective IPS is typically 5-15 pages long, balancing comprehensiveness with clarity and usability.

How often should an Investment Policy Statement be reviewed?

An IPS should be reviewed annually, with additional reviews following significant life events or major market changes.

Is an Investment Policy Statement legally binding?

While not typically legally binding for individual investors, an IPS can serve as important documentation of the agreed-upon investment strategy.

Can I create an Investment Policy Statement on my own?

While possible, it’s often beneficial to work with a financial advisor to ensure your IPS is comprehensive and aligned with best practices.

Should an Investment Policy Statement include specific investment recommendations?

Generally, an IPS should focus on overall strategy and guidelines rather than specific investment recommendations, which may change over time.

Conclusion

An Investment Policy Statement is a vital tool for effective portfolio management, providing clarity, discipline, and direction in the investment process.

By clearly outlining investment objectives, risk tolerance, and strategy, an IPS helps investors and their advisors make informed decisions and stay focused on long-term goals.

Creating and implementing an effective IPS requires careful consideration and ongoing commitment. However, the benefits of having a well-crafted IPS far outweigh the effort involved.

It promotes consistency in decision-making, facilitates better communication between investors and advisors, and provides a framework for evaluating performance and making necessary adjustments.

Marcus Delgado is a certified financial planner with expertise in retirement strategies and tax optimization.

With a background in economics and a passion for helping individuals achieve financial freedom, Marcus provides practical advice on long-term wealth building and smart money management.