In the world of investing, the relationships between different variables can have a profound impact on the performance of an investment portfolio.

Understanding the nature of these relationships whether they are direct or inverse is a critical skill for investors to develop.

By recognizing the connections between various factors, investors can better predict how changes in one element will affect the others, allowing them to make more informed decisions and effectively manage the risks associated with their investments.

Understanding Relationships In Investing

The concepts of direct and inverse relationships are fundamental to the field of investing.

Investors who can navigate these relationships with confidence are often better equipped to navigate the complex and ever-changing financial landscape.

Direct Relationships

A direct relationship in investing refers to a clear and identifiable connection between two variables where a change in one variable leads to a corresponding change in the other variable in the same direction. In other words, as one variable increases, the other variable also increases.

Examples Of Direct Relationships

One of the most well-known examples of a direct relationship in investing is the connection between a company’s financial performance and its stock price.

As a company’s earnings, revenue and other key metrics improve, investors typically respond by bidding up the stock price, reflecting the company’s enhanced growth prospects and profitability.

Another example of a direct relationship is the link between commodity prices and the stocks of companies closely tied to those commodities.

When the price of oil rises the stock prices of oil exploration and production companies often increase in tandem, as their profitability and growth prospects improve.

Inverse Relationships

In contrast, an inverse relationship in investing refers to a connection between two variables where a change in one variable leads to a corresponding change in the other variable in the opposite direction. As one variable increases the other variable decreases.

Examples Of Inverse Relationships

One of the most well-known examples of an inverse relationship in investing is the relationship between interest rates and bond prices. As interest rates rise, the prices of existing bonds tend to fall.

As newer bonds issued with higher yields become more attractive to investors. Conversely, when interest rates decline, the prices of existing bonds typically increase, as their fixed yields become more valuable in the current market environment.

Another example of an inverse relationship is the relationship between the overall health of the economy and the performance of defensive stocks such as those in the consumer staples or healthcare sectors.

When the economy is strong and growing investors tend to shift their focus to more cyclical and growth-oriented stocks. Conversely, when the economy is weak or in a recession, investors may gravitate towards defensive stocks, which tend to be more resilient during economic downturns.

Read This Blog: What Is A Direct Relationship In Investing?

Analyzing Relationships In Investing

Understanding and analyzing the relationships between different variables is a critical skill for investors to develop. By identifying and understanding these relationships, investors can better assess the risks and potential rewards associated with their investments, and make more informed decisions.

Tools And Techniques For Analysis

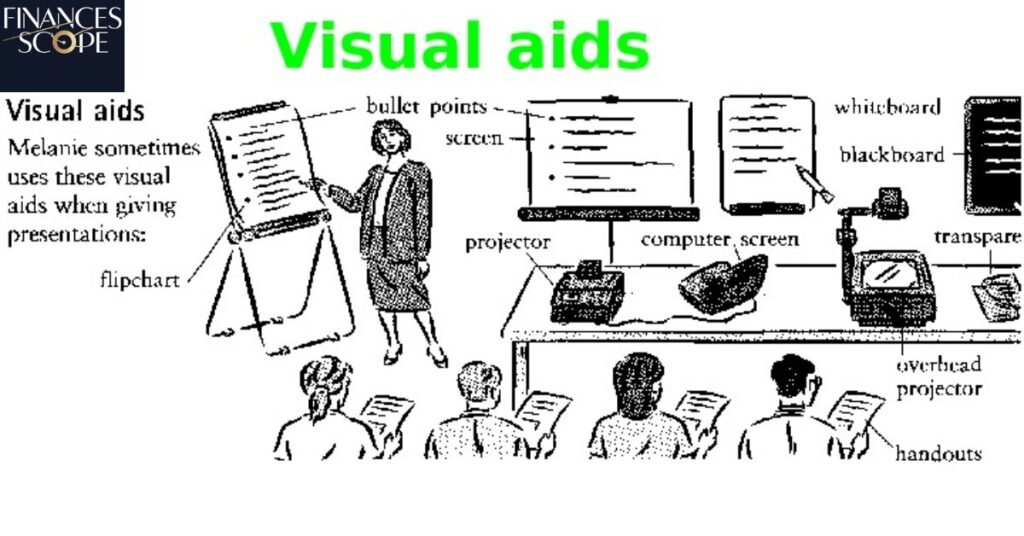

There are various tools and techniques that investors can use to analyze relationships in investing. These include statistical analysis, regression models, and the use of visual aids such as scatter plots and correlation coefficients.

Statistical Analysis

One of the most common techniques for analyzing relationships in investing is statistical analysis. This involves using statistical methods, such as correlation analysis and regression analysis to identify the strength and direction of the relationship between two or more variables.

Correlation analysis, for example, can be used to measure the degree of linear association between two variables, with a correlation coefficient ranging from -1 to 1.

A positive correlation coefficient indicates a direct relationship, while a negative correlation coefficient indicates an inverse relationship.

Regression analysis, on the other hand, can be used to model the relationship between a dependent variable (such as investment returns) and one or more independent variables (such as economic indicators or market factors).

This can help investors understand the nature and strength of the relationship, and use this information to make more informed investment decisions.

Visual Aids

In addition to statistical analysis, investors can also use visual aids, such as scatter plots and correlation matrices, to help identify and analyze relationships in investing.

Scatter plots, for example, can be used to graphically represent the relationship between two variables, making it easier to identify patterns and trends.

Correlation matrices on the other hand, can be used to visualize the relationships between multiple variables, allowing investors to quickly identify the strongest and weakest relationships within a dataset.

Limitations And Considerations

While analyzing relationships in investing can provide valuable insights it’s important to recognize that these relationships are not always static or absolute.

Market conditions, investor sentiment and other external factors can influence the strength and direction of these relationships over time.

Read This Blog: How To Set Up Automatic Investments On Fidelity?

Accounting For Complexity

Investing is a complex and dynamic endeavor and the relationships between various factors are not always straightforward.

Investors should be prepared to adapt their strategies and decision-making processes as market conditions evolve and be mindful of the potential for unexpected or unpredictable outcomes.

Diversification

Ultimately, investors should not rely too heavily on any single relationship or factor when making investment decisions.

They should strive to maintain a well-diversified portfolio that takes into account the broader macroeconomic environment and the potential for changes in the relationships between different variables over time.

Frequently Asked Questions

What is a direct relationship in investing?

A direct relationship in investing refers to a clear and identifiable connection between two variables or factors.

What is an inverse relationship in investing?

An inverse relationship in investing refers to a connection between two variables where a change in one variable leads to a corresponding change in the other variable in the opposite direction.

How can investors analyze relationships in investing?

Investors can use a variety of tools and techniques to analyze relationships in investing, including statistical analysis and visual aids.

What are some limitations and considerations when analyzing relationships in investing?

While analyzing relationships can provide valuable insights, it’s important to recognize that these relationships are not always static or absolute. Market conditions, investor sentiment, and other external factors can influence the strength and direction of these relationships over time.

Why is it important for investors to understand direct and inverse relationships?

Understanding direct and inverse relationships is crucial for investors, as it allows them to better predict how changes in one factor will impact the performance of their investments, identify potential opportunities and trends in the market, and make more informed decisions to manage the risks associated with their portfolios.

Conclusion

The relationships between different variables in investing can have a significant impact on the performance of an investment portfolio. Understanding the nature of these relationships, whether they are direct or inverse is a critical skill for investors to develop.

By using various tools and techniques to analyze these relationships, investors can better assess the risks and potential rewards associated with their investments and make more informed decisions.

It’s important to recognize that these relationships are not always static or absolute and that investors should be prepared to adapt their strategies and decision-making processes as market conditions evolve.

The ability to understand and analyze relationships in investing is a valuable asset for any investor, as it can help them navigate the complex and ever-changing financial landscape and achieve their long-term investment goals.

Marcus Delgado is a certified financial planner with expertise in retirement strategies and tax optimization.

With a background in economics and a passion for helping individuals achieve financial freedom, Marcus provides practical advice on long-term wealth building and smart money management.