In the world of investing the concept of a direct relationship is a fundamental one that every investor should understand.

A direct relationship in the context of investing, refers to a clear and identifiable connection between two variables or factors that influence the performance of an investment.

This relationship can be positive or negative, and it can have significant implications for investors as they make decisions about how to allocate their resources. Understanding direct relationships is crucial for investors.

As it allows them to better predict how changes in one factor will impact the performance of their investments, identify potential opportunities and trends in the market, and make more informed decisions to manage the risks associated with their portfolios.

Understanding Direct Relationships In Investing

This knowledge can help them make more informed decisions and better manage the risks associated with their portfolios. Recognizing direct relationships can help investors identify potential opportunities and trends in the market, which can be particularly valuable in volatile or uncertain environments.

The Importance Of Understanding Direct Relationships

Understanding direct relationships in investing is crucial for several reasons. First, it allows investors to better predict how changes in one factor will impact the performance of their investments.

Avoiding Misconceptions

One of the key benefits of understanding direct relationships is the ability to avoid common misconceptions and biases that can lead to poor investment decisions.

By recognizing the true nature of the relationships between different factors, investors can make more objective and well-informed choices, rather than relying on intuition or incomplete information.

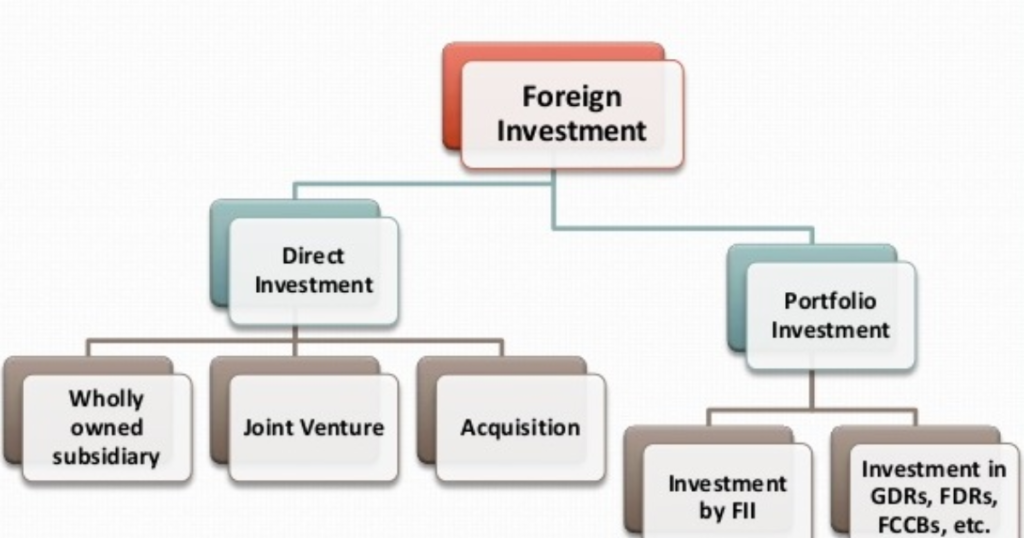

Examples Of Direct Relationships In Investing

Direct relationships in investing can take many forms and they can be observed across a wide range of asset classes and investment strategies. Here are some common examples:

Stock Prices and Company Performance

Perhaps one of the most well-known direct relationships in investing is the connection between a company’s financial performance and the price of its stock.

As a company’s earnings revenue, and other key metrics improve investors typically respond by bidding up the stock price reflecting the company’s enhanced growth prospects and profitability.

A prime example of this direct relationship is the market’s reaction to a company’s earnings announcements.

When a company reports stronger-than-expected earnings, the stock price often rises, as investors see the improved performance as a positive indicator of the company’s future growth potential.

Interest Rates And Bond Prices

Another direct relationship in investing is the inverse relationship between interest rates and bond prices. As interest rates rise, the prices of existing bonds tend to fall, as newer bonds issued with higher yields become more attractive to investors.

When interest rates decline, the prices of existing bonds typically increase as their fixed yields become more valuable in the current market environment.

Read This Blog: How To Set Up Automatic Investments On Fidelity?

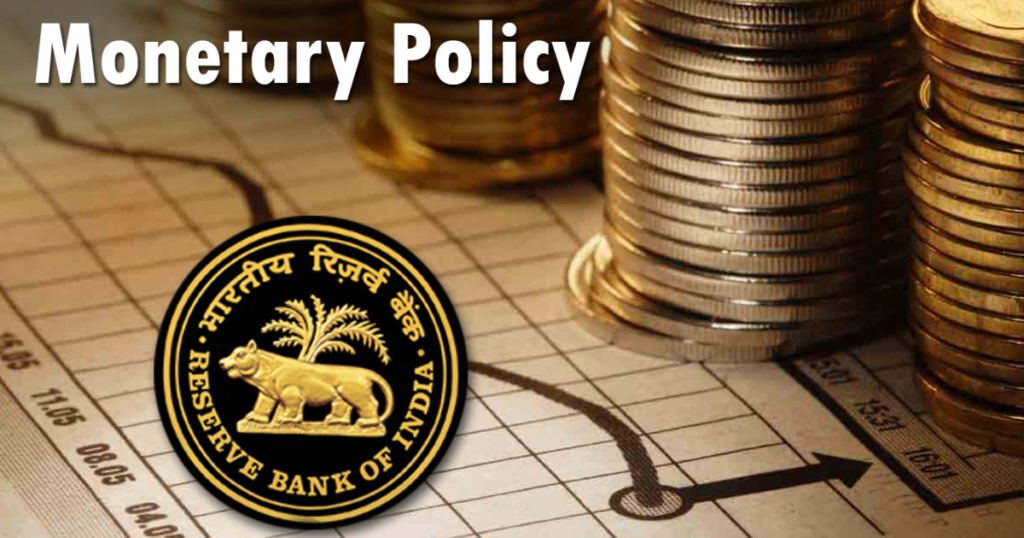

The Impact Of Monetary Policy

Changes in monetary policy, such as interest rate hikes or cuts by central banks, can have a direct impact on bond prices, as investors adjust their portfolios in response to the altered interest rate environment.

Commodity Prices And Related Stocks

The prices of commodities such as oil, gold, or agricultural products, can also have a direct relationship with the stock prices of companies that are closely tied to those commodities.

When the price of oil rises the stock prices of oil exploration and production companies often increase in tandem, as their profitability and growth prospects improve.

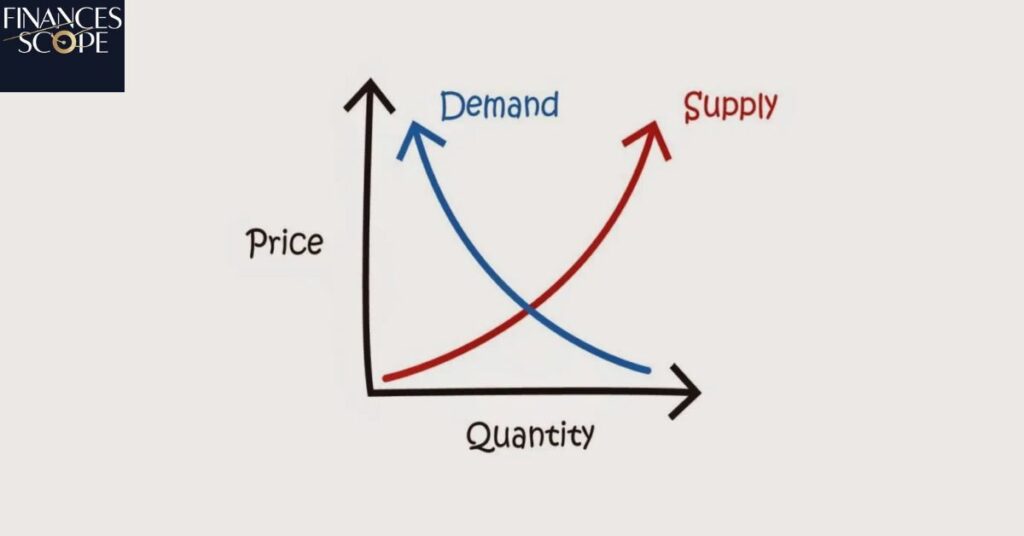

The Impact Of Supply And Demand

Fluctuations in commodity prices are often driven by changes in supply and demand dynamics which can directly affect the financial performance and stock prices of companies within the related industries.

Economic Growth And Stock Market Performance

There is generally a positive direct relationship between the overall health of the economy and the performance of the stock market.

When the economy is growing, with increasing employment consumer spending, and business investment, the stock market tends to perform well, as investors anticipate improved corporate earnings and future growth.

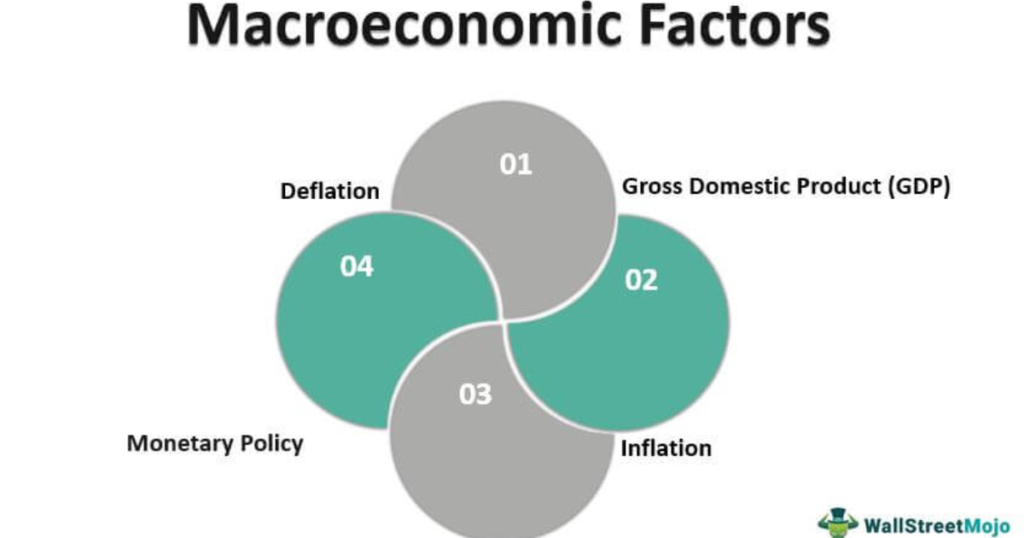

The Impact Of Macroeconomic Indicators

Key economic indicators, such as GDP growth unemployment rates, and consumer confidence, can provide valuable insights into the state of the economy and its direct influence on stock market performance.

Analyzing Direct Relationships In Investing

Identifying and analyzing direct relationships in investing is a critical skill for investors to develop.

By understanding these relationships, investors can better assess the risks and potential rewards associated with their investments and make more informed decisions.

Tools And Techniques For Analysis

There are various tools and techniques that investors can use to analyze direct relationships in investing. These include statistical analysis regression models, and the use of visual aids such as scatter plots and correlation coefficients.

The Importance Of Data And Research

Effective analysis of direct relationships requires access to reliable and comprehensive data, as well as a deep understanding of the underlying factors that drive investment performance.

Investors may need to conduct extensive research and stay up-to-date with the latest market trends and economic developments to fully appreciate the nuances of these relationships.

Limitations And Considerations

While direct relationships in investing can provide valuable insights, it’s important to recognize that they are not always static or absolute. Market conditions, investor sentiment, and other external factors can influence the strength and direction of these relationships over time.

Investors should be cautious about relying too heavily on any single direct relationship and should instead strive to maintain a well-diversified portfolio that takes into account the broader macroeconomic environment.

Read This Blog: What Is RBW Investment Team On WhatsApp?

Accounting For Complexity

Investing is a complex and dynamic endeavor, and the relationships between various factors are not always straightforward.

Investors should be prepared to adapt their strategies and decision-making processes as market conditions evolve and be mindful of the potential for unexpected or unpredictable outcomes.

Frequently Asked Questions

What is a direct relationship in investing?

A direct relationship in investing refers to a clear and identifiable connection between two variables or factors that influence the performance of an investment.

Why is understanding direct relationships important for investors?

Understanding direct relationships in investing allows investors to better predict how changes in one factor will impact the performance of their investments.

Can you provide some examples of direct relationships in investing?

Common examples of direct relationships in investing include the connection between a company’s financial performance and its stock price, the inverse relationship between interest rates and bond prices.

What tools and techniques can investors use to analyze direct relationships?

Investors can use various tools and techniques to analyze direct relationships, such as statistical analysis, regression models, and visual aids like scatter plots and correlation coefficients.

What are some limitations and considerations when analyzing direct relationships?

While direct relationships can provide valuable insights, they are not always static or absolute. Market conditions, investor sentiment, and other external factors can influence the strength and direction of these relationships over time.

Conclusion

Direct relationships in investing are a fundamental concept that every investor should understand.

By recognizing the clear connections between various factors and their impact on investment performance, investors can make more informed decisions, better manage risk, and identify potential opportunities in the market.

It’s important to remember that investing is a complex and dynamic endeavor and the relationships between different variables are not always straightforward.

Investors must be prepared to adapt their strategies and decision-making processes as market conditions evolve, while maintaining a well-diversified portfolio that takes into account the broader macroeconomic environment.

By mastering the art of analyzing direct relationships in investing, investors can gain a competitive edge and position themselves for long-term success in the ever-changing financial landscape.

Marcus Delgado is a certified financial planner with expertise in retirement strategies and tax optimization.

With a background in economics and a passion for helping individuals achieve financial freedom, Marcus provides practical advice on long-term wealth building and smart money management.