Global warming a pressing issue of our time presents not only challenges but also opportunities for investors.

As the world grapples with the effects of climate change there is a growing need for solutions that can mitigate its impact and adapt to the changing environment.

This shift has created a new landscape for investments where environmental consciousness meets financial opportunity.

In this article we will explore various sectors and strategies that investors can consider when looking to align their portfolios with the fight against global warming while potentially reaping financial benefits.

Understanding The Investment Landscape

The investment landscape is rapidly evolving, with a growing emphasis on sustainability and environmental impact. Investors are increasingly considering factors such as ESG (Environmental, Social, and Governance) criteria when making decisions.

Understanding this shift is crucial for those looking to align their portfolios with long-term trends and opportunities in green finance and sustainable industries.

The Impact Of Global Warming On Markets

Global warming affects various sectors of the economy including:

- Agriculture and food production

- Energy and utilities

- Real estate and infrastructure

- Transportation and logistics

- Insurance and risk management

Regulatory Environment

Investors must consider:

- International agreements like the Paris Climate Accord

- National and regional climate policies

- Carbon pricing mechanisms and emissions trading systems

Market Trends

Key trends shaping the investment landscape include:

- Increasing consumer demand for sustainable products

- Corporate commitments to carbon neutrality

- Technological advancements in clean energy and efficiency

Renewable Energy Investments

Renewable energy investments are at the forefront of the global transition to a low-carbon economy. As wind, solar, and other clean energy sources become more cost-effective, they present lucrative opportunities for investors.

These investments not only offer potential for significant returns but also contribute to reducing greenhouse gas emissions and combating climate change.

Solar Power

The solar energy sector offers various investment opportunities:

- Solar panel manufacturers

- Installation and maintenance companies

- Solar farm operators and developers

Wind Energy

Investing in wind power can include:

- Wind turbine manufacturers

- Offshore and onshore wind farm projects

- Wind energy storage solutions

Hydroelectric Power

Potential investments in hydroelectric energy encompass:

- Dam construction and maintenance firms

- Hydroelectric equipment manufacturers

- Companies specializing in small-scale hydro projects

Geothermal Energy

The geothermal sector includes investments in:

- Geothermal power plant operators

- Drilling and exploration companies

- Heat pump manufacturers for residential and commercial use

Read This Blog: How To Invest In Anticipation Of Hurricane Season?

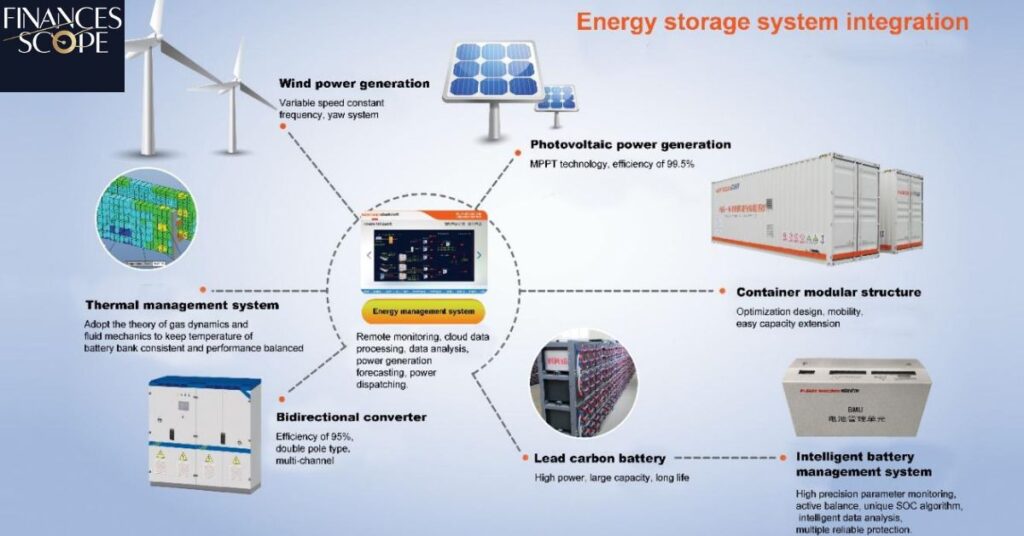

Energy Efficiency And Storage

Energy efficiency and storage are critical components of a sustainable energy future. Investments in technologies that reduce energy consumption or enhance energy storage, such as advanced batteries and smart grids, are gaining traction.

These sectors offer opportunities for investors to support the transition to a more resilient and efficient energy infrastructure.

Smart Grid Technologies

Investing in smart grid solutions involves:

- Grid modernization equipment manufacturers

- Software companies developing energy management systems

- Advanced metering infrastructure providers

Energy Storage Solutions

Opportunities in energy storage include:

- Battery manufacturers and developers

- Pumped hydro storage projects

- Emerging technologies like hydrogen storage

Building Efficiency

Investments in building efficiency can focus on:

- Insulation and building material companies

- Smart thermostat and HVAC control systems

- Energy-efficient lighting and appliance manufacturers

Sustainable Transportation

Sustainable transportation is revolutionizing the automotive and logistics sectors. Electric vehicles (EVs), public transit innovations, and sustainable supply chain practices are driving this change.

Investors can capitalize on the growth of these markets as governments and consumers increasingly prioritize low-emission and efficient transportation options.

Electric Vehicles (EV’s)

The EV market offers investment potential in:

- Electric car manufacturers

- EV battery technology companies

- Charging infrastructure providers

Public Transportation

Investing in sustainable public transit can include:

- Electric bus and train manufacturers

- Ride-sharing and micro-mobility companies

- Transit system operators focusing on low-emission solutions

Alternative Fuels

Opportunities in alternative fuels encompass:

- Biofuel producers and distributors

- Hydrogen fuel cell technology companies

- Synthetic fuel developers

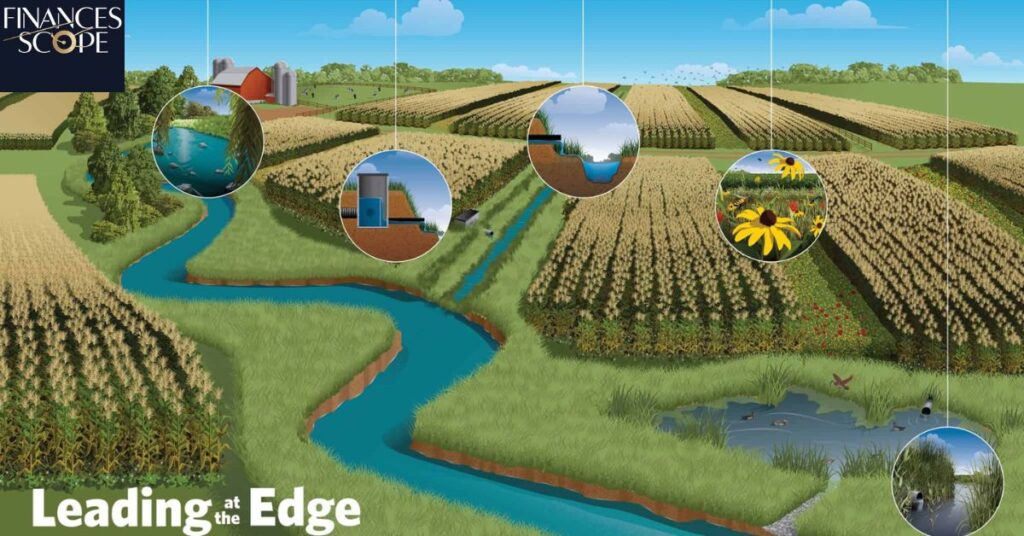

Sustainable Agriculture And Food Systems

Sustainable agriculture and food systems are becoming essential as the global population grows and climate change impacts food security.

Investments in organic farming, plant-based foods, and technologies that enhance agricultural productivity while reducing environmental harm are increasingly attractive for those focused on long-term sustainability.

Precision Agriculture

Investments in precision agriculture include:

- Farm management software developers

- Drone and satellite imaging companies for crop monitoring

- Smart irrigation system manufacturers

Plant-Based And Alternative Proteins

The growing alternative protein market offers opportunities in:

- Plant-based meat and dairy companies

- Cellular agriculture and lab-grown meat startups

- Insect protein producers

Vertical Farming

Vertical farming investments can focus on:

- Indoor farming technology providers

- Urban agriculture startups

- Hydroponic and aeroponic system manufacturers

Read This Blog: Can Corporations Claim Business Investment Loss?

Water Management And Conservation

Water management and conservation are critical as water scarcity becomes a more pressing global issue.

Investments in technologies and infrastructure that promote efficient water use, recycling, and desalination are gaining importance.

These sectors present opportunities for investors to address a fundamental resource challenge while achieving steady returns.

Water Treatment And Purification

Investing in water treatment can include:

- Desalination technology companies

- Advanced filtration system manufacturers

- Wastewater treatment plant operators

Water Conservation Technologies

Opportunities in water conservation encompass:

- Smart water meter manufacturers

- Leak detection and prevention system developers

- Drought-resistant landscaping companies

Flood Management

Investments in flood management can focus on:

- Flood barrier and seawall construction firms

- Storm water management system providers

- Flood prediction and early warning technology developers

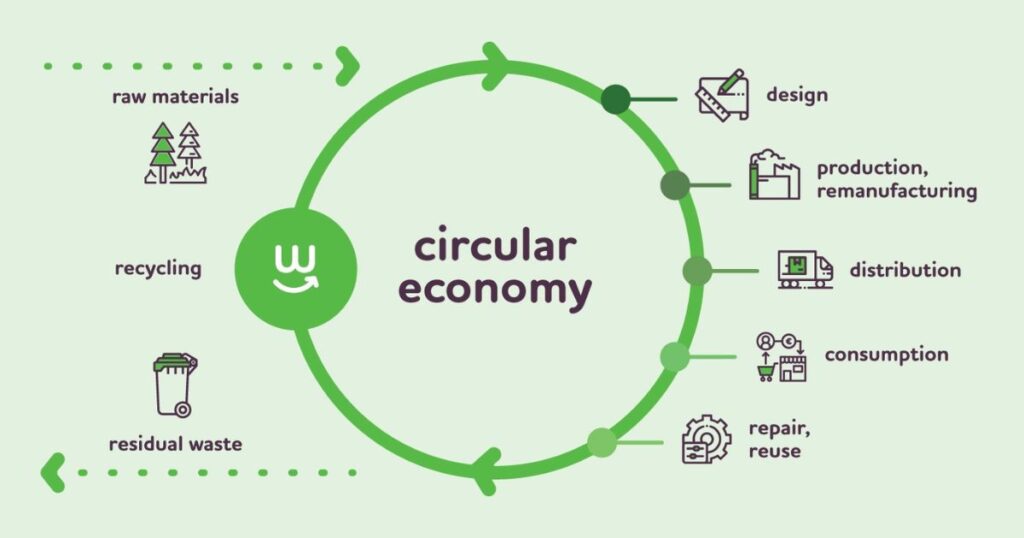

Waste Management And Circular Economy

The shift towards a circular economy, where waste is minimized and resources are reused, is transforming waste management.

Investments in recycling technologies, waste-to-energy initiatives, and sustainable materials are key to this transition.

Investors can play a significant role in promoting a more sustainable and resource-efficient economy.

Recycling Technologies

The recycling sector offers investments in:

- Advanced sorting and processing equipment manufacturers

- Chemical recycling technology developers

- Recycled material product companies

Waste-to-Energy

Opportunities in waste-to-energy include:

- Biogas and landfill gas capture systems

- Incineration technology providers

- Anaerobic digestion plant operators

Circular Economy Solutions

Investing in the circular economy can focus on:

- Product design firms specializing in recyclable and reusable goods

- Sharing economy platforms and services

- Repair and refurbishment companies

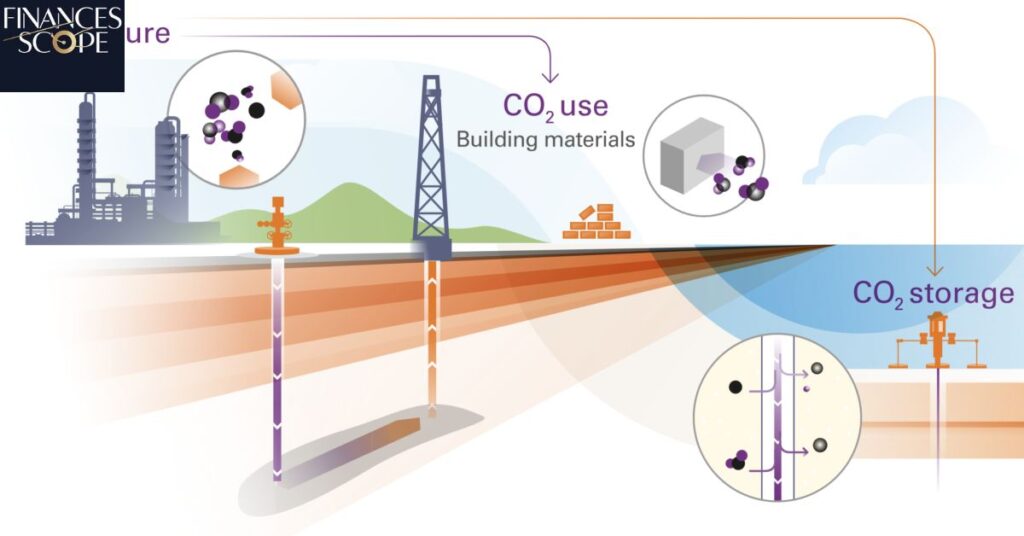

Carbon Capture And Storage

Carbon capture and storage (CCS) technologies are emerging as vital tools in the fight against climate change.

These technologies aim to capture carbon emissions from industrial processes and store them underground, reducing atmospheric CO2 levels.

Investing in CCS presents an opportunity to support innovative solutions that are crucial for achieving net-zero emissions targets.

Direct Air Capture

Investments in direct air capture technology include:

- Companies developing carbon capture equipment

- Carbon utilization technology firms

- Projects focused on large-scale atmospheric CO2 removal

Industrial Carbon Capture

Opportunities in industrial carbon capture encompass:

- Point-source carbon capture technology providers

- CO2 transportation and storage infrastructure developers

- Companies specializing in carbon-negative building materials

- Natural Carbon Sinks

- Investing in natural carbon sinks can include:

- Reforestation and afforestation project developers

- Blue carbon initiatives focusing on coastal ecosystems

- Sustainable land management and regenerative agriculture companies

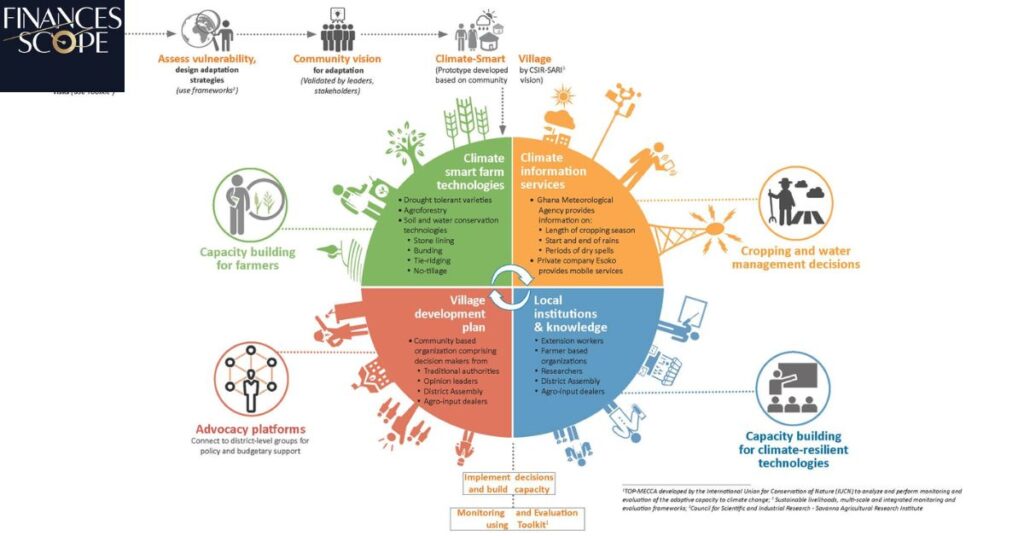

Climate Adaptation Technologies

Climate adaptation technologies are becoming increasingly important as the impacts of climate change intensify.

These technologies, which include resilient infrastructure, flood defenses, and drought-resistant crops, help communities and businesses adapt to changing environmental conditions.

Investing in this area is critical for addressing the immediate challenges posed by climate change.

Coastal Protection

Investments in coastal protection can focus on:

- Companies developing artificial reefs and living shorelines

- Coastal engineering and construction firms

- Makers of erosion control products

Resilient Infrastructure

Opportunities in resilient infrastructure include:

- Developers of climate-resistant building materials

- Engineering firms specializing in climate-adaptive design

- Providers of early warning systems for extreme weather events

Heat Mitigation Technologies

Investing in heat mitigation can encompass:

- Cool roof and pavement technology companies

- Urban greening and vertical garden developers

- Manufacturers of high-efficiency cooling systems

Green Finance And Sustainable Investing

Green finance and sustainable investing are gaining momentum as investors seek to align their portfolios with environmental and social goals.

This includes investments in green bonds, ESG-focused funds, and sustainable companies. The growth of green finance reflects a broader shift towards more responsible and impact-driven investment strategies.

Green Bonds

Investing in green bonds involves:

- Government-issued green bonds for environmental projects

- Corporate green bonds funding sustainable initiatives

- Green bond funds and ETFs

ESG Funds

Environmental Social and Governance(ESG) investments include:

- Mutual funds and ETFs with strong environmental criteria

- Impact investing funds focused on climate solutions

- Sustainable index funds tracking low-carbon benchmarks

Carbon Credits And Offsets

Opportunities in carbon markets encompass:

- Carbon credit trading platforms

- Project developers generating carbon offsets

- Funds specializing in carbon credit investments

Emerging Technologies

Emerging technologies, such as AI, blockchain, and biotech, are playing a transformative role in advancing sustainability.

These innovations are enabling more efficient resource management, reducing environmental impacts, and creating new opportunities for growth.

Investors who focus on these cutting-edge technologies can potentially capitalize on their disruptive potential.

Artificial Intelligence for Climate Solutions

AI investments related to climate change include:

- Companies using AI for climate modeling and prediction

- Startups applying machine learning to energy efficiency

- AI-driven platforms for optimizing renewable energy systems

Blockchain For Sustainability

Blockchain applications in sustainability offer opportunities in:

- Companies developing blockchain-based carbon trading systems

- Startups using blockchain for supply chain transparency

- Decentralized energy trading platforms

Geoengineering Research

While controversial geoengineering investments may include:

- Research institutions studying solar radiation management

- Companies developing ocean fertilization technologies

- Stratospheric aerosol injection project developers

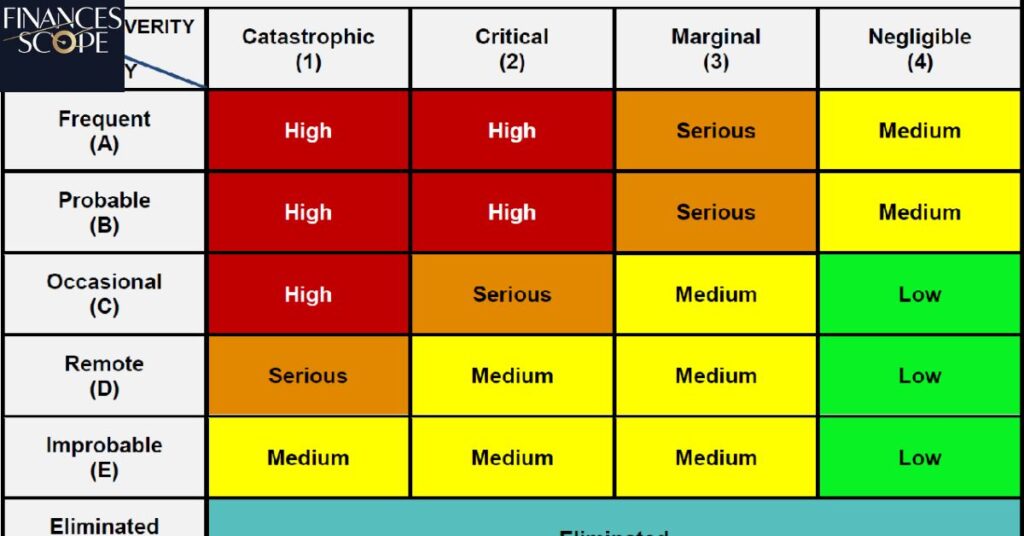

Risk Assessment And Management

Risk assessment and management are essential in the context of sustainable investing. Investors must consider not only financial risks but also environmental and social risks that could impact long-term returns.

By incorporating comprehensive risk analysis into their strategies, investors can better navigate the uncertainties associated with sustainability-focused investments.

Climate Risk Analysis

Investing in climate risk assessment can focus on:

- Companies providing climate risk modeling and analytics

- Firms offering climate-related financial disclosure services

- Developers of tools for assessing physical climate risks to assets

Catastrophe Bonds

Opportunities in catastrophe bonds include:

- Insurance-linked securities tied to climate-related events

- Funds specializing in catastrophe bond investments

- Companies structuring and managing cat bond issuances

Climate Insurance Innovations

Investments in climate insurance innovations encompass:

- Parametric insurance providers for climate-related risks

- Startups developing microinsurance for climate-vulnerable populations

- Companies offering crop insurance solutions for changing climate conditions

Frequently Asked Questions

What are the most promising sectors for global warming investments?

Renewable energy, energy efficiency, sustainable transportation, and climate adaptation technologies are among the most promising sectors for investors looking to address global warming.

Are global warming investments risky?

All investments carry risk, many global warming-related investments are becoming more mainstream and may offer long-term growth potential as the world transitions to a low-carbon economy.

How can small investors participate in global warming-related investments?

Small investors can participate through publicly traded stocks, mutual funds, and ETFs focused on clean energy, sustainability, and climate solutions, as well as through green bonds and crowdfunding platforms for climate tech startups.

What role do government policies play in global warming investments?

Government policies, such as carbon pricing, renewable energy incentives, and emissions regulations, can significantly impact the success and growth of global warming-related investments.

How do global warming investments perform compared to traditional investments?

Performance varies, but many sustainable and climate-focused investments have shown competitive returns in recent years, with some outperforming traditional investments as awareness of climate risks increases.

Conclusion

Investing in solutions to global warming presents a unique opportunity to align financial goals with environmental stewardship.

As the world increasingly recognizes the urgent need to address climate change, investments in renewable energy, energy efficiency, sustainable transportation, and other climate-related sectors are likely to play a crucial role in shaping the future economy.

These investments come with their own set of risks and challenges, they also offer the potential for significant growth as governments, businesses, and consumers prioritize sustainability and climate resilience.

From established industries like solar and wind power to emerging technologies in carbon capture and AI-driven climate solutions, the landscape of global warming investments is diverse and evolving.

Marcus Delgado is a certified financial planner with expertise in retirement strategies and tax optimization.

With a background in economics and a passion for helping individuals achieve financial freedom, Marcus provides practical advice on long-term wealth building and smart money management.