VOO, or the Vanguard S&P 500 ETF, is a popular investment option that tracks the performance of the S&P 500 index.

This exchange-traded fund (ETF) offers investors exposure to 500 of the largest U.S. companies, providing a diversified portfolio with a single investment.

As investors seek ways to grow their wealth and achieve their financial goals, many wonder if VOO is a good choice for their investment strategy.

Understanding VOO And Its Performance

The Vanguard S&P 500 ETF (VOO) is designed to replicate the performance of the S&P 500 index, which is widely regarded as a benchmark for the overall U.S. stock market.

By investing in VOO, you gain exposure to a diverse range of large-cap U.S. companies across various sectors.

This ETF is known for its low expense ratio, broad market coverage, and potential for long-term growth, making it an attractive option for many investors.

What is VOO?

VOO, or the Vanguard S&P 500 ETF, is an exchange-traded fund that aims to track the performance of the S&P 500 index. Launched by Vanguard in 2010.

This ETF has quickly become one of the most popular investment options for both individual and institutional investors.

VOO provides exposure to 500 of the largest U.S. companies, offering investors a simple way to diversify their portfolio across various sectors and industries.

The S&P 500 index, which VOO tracks, is a market-capitalization-weighted index, meaning that larger companies have a greater impact on the fund’s performance. This approach ensures that the ETF reflects the overall performance of the U.S. stock market, with a focus on large-cap stocks.

By investing in VOO, you’re essentially buying a small piece of each company in the S&P 500, allowing you to benefit from the collective performance of these top U.S. corporations.

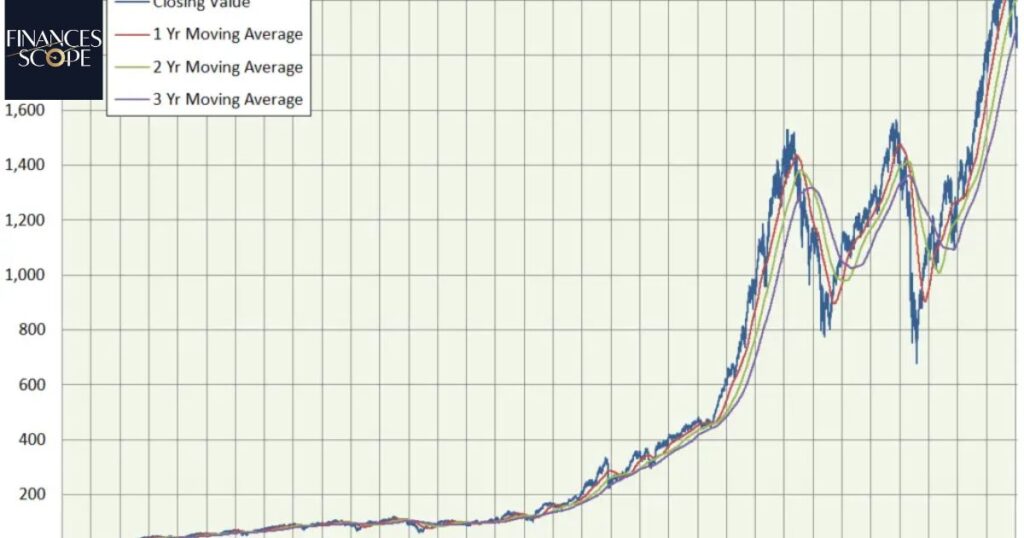

VOO’s Historical Performance

Since its inception, VOO has demonstrated strong performance, closely mirroring the returns of the S&P 500 index. Over the past decade, the fund has delivered impressive annual returns, often outperforming many actively managed mutual funds.

It’s important to note that past performance doesn’t guarantee future results, but VOO’s track record has been consistently strong.

One of the key factors contributing to VOO’s performance is its low expense ratio. With an expense ratio of just 0.03%, VOO is one of the most cost-effective ways to gain exposure to the S&P 500.

This low fee structure means that more of your investment goes directly into the fund, rather than being eaten away by management costs.

Another aspect of VOO’s performance is its ability to provide investors with both capital appreciation and dividend income. Many of the companies in the S&P 500 pay dividends, and VOO passes these dividends on to its shareholders.

This combination of potential price appreciation and regular dividend payments can contribute to the overall total return of the investment.

Comparing VOO To Other Investment Options

When considering VOO as an investment, it’s helpful to compare it to other options available in the market. One common comparison is between VOO and actively managed mutual funds.

While some actively managed funds may outperform the S&P 500 in certain years, studies have shown that over the long term, the majority of active funds fail to consistently beat the index.

Another comparison is between VOO and other S&P 500 ETFs, such as SPY (SPDR S&P 500 ETF Trust) and IVV (iShares Core S&P 500 ETF). While these ETFs all track the same index, there are slight differences in their expense ratios, trading volumes, and assets under management.

VOO often stands out due to its exceptionally low expense ratio, making it an attractive choice for cost-conscious investors.

It’s also worth comparing VOO to broader market ETFs that track indexes like the Total Stock Market Index.

While these funds offer exposure to a wider range of companies, including small and mid-cap stocks, VOO’s focus on large-cap stocks can be advantageous for investors seeking stability and consistent performance from established companies.

Advantages Of Investing In VOO

Investing in VOO offers several advantages that make it an attractive option for many investors. Understanding these benefits can help you determine if VOO aligns with your investment goals and strategy.

Diversification

One of the primary advantages of investing in VOO is the instant diversification it provides. By holding shares of VOO, you gain exposure to 500 of the largest U.S. companies across various sectors.

This broad diversification helps to reduce the risk associated with investing in individual stocks, as the poor performance of one company or sector can be offset by the stronger performance of others.

The S&P 500 includes companies from 11 different sectors, including technology, healthcare, financials, consumer discretionary, and more.

This sector diversification ensures that your investment is not overly concentrated in any single area of the economy, providing a more balanced approach to investing.

Moreover, the market-cap weighting of the S&P 500 means that VOO naturally adjusts its holdings as companies grow or shrink in size.

This built-in rebalancing mechanism helps to maintain diversification and keeps the fund aligned with the overall market trends.

Low Costs

Another significant advantage of VOO is its extremely low cost structure. With an expense ratio of just 0.03%, VOO is one of the most cost-effective ways to invest in the S&P 500.

This low fee means that more of your investment goes directly into the fund, rather than being consumed by management expenses.

The impact of low fees becomes even more apparent over time due to the power of compounding. Even small differences in expense ratios can lead to significant differences in returns over long investment horizons.

By choosing a low-cost option like VOO, investors can potentially keep more of their returns and achieve better long-term results.

In addition to the low expense ratio, VOO typically has low trading costs due to its high liquidity and tight bid-ask spreads.

This makes it an efficient option for both long-term investors and those who may need to buy or sell shares more frequently.

Simplicity And Transparency

Investing in VOO offers a level of simplicity and transparency that can be appealing to many investors, especially those who prefer a passive investment approach. The fund’s objective is straightforward: to track the performance of the S&P 500 index.

This clear goal makes it easy for investors to understand what they’re investing in and how the fund is likely to perform relative to the broader market.

The transparency of VOO is also noteworthy. As an ETF, VOO’s holdings are disclosed daily, allowing investors to see exactly which companies they own through the fund.

This level of transparency is not always available with actively managed mutual funds, which may only disclose their holdings quarterly.

Furthermore, the passive management approach of VOO means that there’s no need to worry about a fund manager making poor investment decisions or deviating from the stated investment strategy.

The fund simply aims to replicate the performance of the S&P 500, providing investors with a reliable and consistent investment approach.

Potential For Long-Term Growth

While past performance doesn’t guarantee future results, the S&P 500 has historically demonstrated strong long-term growth. By investing in VOO, you’re essentially betting on the continued growth and success of the U.S. economy and its largest companies.

Over long periods, the S&P 500 has consistently delivered positive returns, despite short-term market fluctuations and economic downturns.

This long-term growth potential makes VOO an attractive option for investors with a long investment horizon, such as those saving for retirement or other long-term financial goals.

Additionally, many of the companies in the S&P 500 are multinational corporations with global operations.

This means that by investing in VOO you’re not just gaining exposure to the U.S. economy, but also benefiting from global economic growth and opportunities.

Liquidity And Flexibility

As one of the most popular ETFs in the market, VOO offers excellent liquidity. This high liquidity means that investors can easily buy or sell shares of VOO without significantly impacting the price.

The ability to quickly and efficiently enter or exit positions provides flexibility that can be valuable in various market conditions.

Moreover, as an ETF, VOO can be traded throughout the day like a stock, unlike mutual funds which are priced and traded only once per day.

This intraday trading capability allows investors to react more quickly to market events or adjust their portfolios as needed.

VOO also offers flexibility in terms of investment amount. While some mutual funds may require minimum investments, you can buy as little as one share of VOO (or even fractional shares through some brokers).

This accessibility makes VOO an attractive option for investors of all sizes, from those just starting out to large institutional investors.

Read This Blog: Is SCHD A Good Investment?

Comparing VOO To Other S&P 500 ETFs In 2024:

In 2024, VOO continues to stand out among S&P 500 ETFs due to its ultra-low expense ratio of 0.03%. While competitors like SPY and IVV offer similar exposure to the S&P 500, VOO maintains a slight edge in cost-efficiency.

However, the gap has narrowed as other providers have lowered their fees. Investors are now also considering factors beyond expenses, such as trading volume, tracking error, and securities lending practices.

VOO’s large asset base and Vanguard’s reputation for efficient fund management still make it a top choice, but the decision between S&P 500 ETFs has become increasingly nuanced as the market evolves.

VOO’s Dividend Yield: A Closer Look:

VOO’s dividend yield remains a key attraction for income-focused investors in 2024. As of the latest data, the fund’s yield hovers around 1.5%, reflecting the collective dividend payouts of the S&P 500 companies.

While this yield may seem modest compared to some high-dividend stocks, it’s important to consider VOO’s total return potential, which includes both dividend income and capital appreciation.

The fund’s quarterly dividend distributions have shown steady growth over the years, mirroring the increasing profitability of its underlying companies.

However, investors should note that dividend yields can fluctuate based on market conditions and corporate policies, making it crucial to view VOO’s yield as part of its overall investment proposition rather than in isolation.

Potential Drawbacks Of VOO

While VOO offers many advantages, it’s important to consider potential drawbacks to make an informed investment decision.

Understanding these limitations can help you determine if VOO aligns with your investment goals and risk tolerance.

Limited International Exposure

One of the main limitations of VOO is its focus on U.S. companies. While many of these companies have international operations, the fund doesn’t provide direct exposure to international markets.

This U.S.-centric approach means that investors may miss out on growth opportunities in other parts of the world, particularly in emerging markets.

For investors seeking more global diversification, it may be necessary to complement VOO with international ETFs or other investments that provide exposure to non-U.S. markets.

This could help create a more balanced portfolio that captures growth opportunities from various regions around the world.

Concentration In Large-Cap Stocks

VOO tracks the S&P 500, which is composed of large-cap U.S. companies. While this focus on established, successful companies can provide stability, it also means that the fund may not capture the potential high growth of small and mid-cap stocks.

Smaller companies often have more room for rapid growth, and historically, small-cap stocks have outperformed large-cap stocks over very long periods. By investing solely in VOO, investors may miss out on the growth potential of these smaller companies.

Sector Imbalances

While the S&P 500 covers various sectors, it’s not equally weighted across all sectors. The index, and consequently VOO, can become heavily weighted towards certain sectors based on market capitalization.

For example, in recent years, technology stocks have comprised a significant portion of the S&P 500’s weight.

This sector concentration can lead to imbalances in your portfolio and potentially increase risk if a particular sector faces challenges.

Investors should be aware of these sector weightings and consider whether additional investments are needed to achieve their desired sector allocation.

Lack Of Downside Protection

As a passive investment that tracks the S&P 500, VOO doesn’t employ any strategies to protect against market downturns. When the overall market declines, VOO will generally decline as well.

This lack of downside protection can be concerning for risk-averse investors or those nearing retirement who may not have the time horizon to wait out market downturns.

Active management strategies or more conservative investments might be necessary for investors who require greater downside protection or who have a lower risk tolerance.

Limited Flexibility In Stock Selection

By design, VOO includes all companies in the S&P 500, regardless of their individual merits or potential future performance.

This means that investors don’t have the ability to avoid companies or sectors they believe may underperform or that don’t align with their personal values.

For investors who want more control over their specific stock holdings or who wish to incorporate environmental, social, and governance (ESG) factors into their investment decisions, a more tailored approach might be necessary.

Read This Blog: Is Shiba Inu A Good Investment?

The Future Outlook For VOO: Potential Risks And Opportunities:

Looking ahead, VOO’s future outlook remains tied to the performance of the broader U.S. economy and the S&P 500 index.

Potential opportunities include continued economic growth, technological advancements, and the resilience of large-cap U.S. companies.

However, risks loom on the horizon, such as inflationary pressures, geopolitical tensions, and the possibility of a market correction after extended bull runs.

The fund’s heavy weighting towards technology sectors could be both a boon and a bane, offering high growth potential but also increased volatility.

Investors should also consider the impact of evolving regulations and the shift towards sustainable investing, which could affect the composition and performance of the S&P 500.

While VOO’s diversified nature provides some buffer against individual stock risks, it remains susceptible to systemic market risks.

Frequently Asked Questions

Is VOO suitable for beginners?

Yes, VOO can be an excellent choice for beginners due to its simplicity, low costs, and broad market exposure.

How often does VOO pay dividends?

VOO typically pays dividends quarterly, distributing the dividends collected from the companies in the S&P 500.

Can I lose money investing in VOO?

Yes, like all investments, VOO carries risk. Its value can decrease if the overall stock market declines.

How does VOO compare to individual stock picking?

VOO offers broader diversification and potentially lower risk compared to picking individual stocks, but may not match the potential returns of successful stock picking.

Is VOO tax-efficient?

Yes, VOO is generally considered tax-efficient due to its low turnover and the tax advantages of the ETF structure.

Conclusion

In conclusion, VOO can be an excellent investment option for many investors, particularly those seeking a low-cost, diversified exposure to the U.S. stock market.

Its broad market coverage, low fees, and potential for long-term growth make it an attractive choice for both beginners and experienced investors alike.

However, like any investment, VOO has its limitations. Its focus on large-cap U.S. stocks means it may not provide the diversification or growth potential that some investors seek.

It doesn’t offer protection against market downturns or the ability to select specific stocks based on individual preferences or analysis.

Ultimately, whether VOO is a good investment depends on your individual financial goals, risk tolerance, and overall investment strategy.

Marcus Delgado is a certified financial planner with expertise in retirement strategies and tax optimization.

With a background in economics and a passion for helping individuals achieve financial freedom, Marcus provides practical advice on long-term wealth building and smart money management.