In today’s fast-paced financial world, automating your investments can be a game-changer. It allows you to maintain a consistent investment strategy, save time, and potentially reduce emotional decision-making.

Schwab one of the leading brokerage firms, offers various tools and services to help investors automate their investment process.

This comprehensive guide will walk you through the steps and options available to automate your investing with Schwab.

Understanding Automated Investing

Automated investing leverages technology to manage investment portfolios with minimal human intervention. It typically involves setting up recurring investments, automatic rebalancing, and using algorithms to make investment decisions based on predetermined criteria.

This approach offers several benefits, including consistency in investment strategy, time savings for investors, reduction of emotional decision-making, cost-effectiveness through lower fees, and easier maintenance of a diversified portfolio.

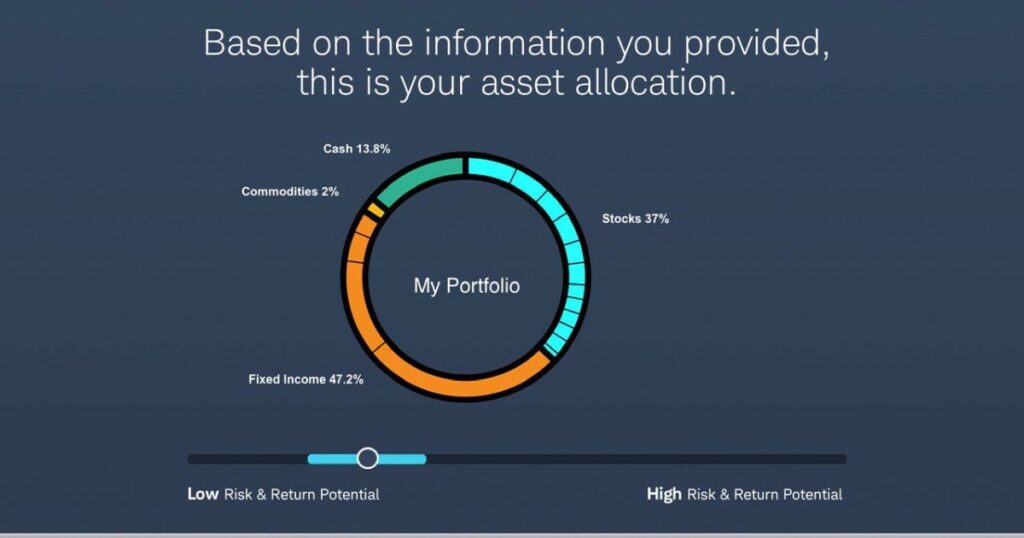

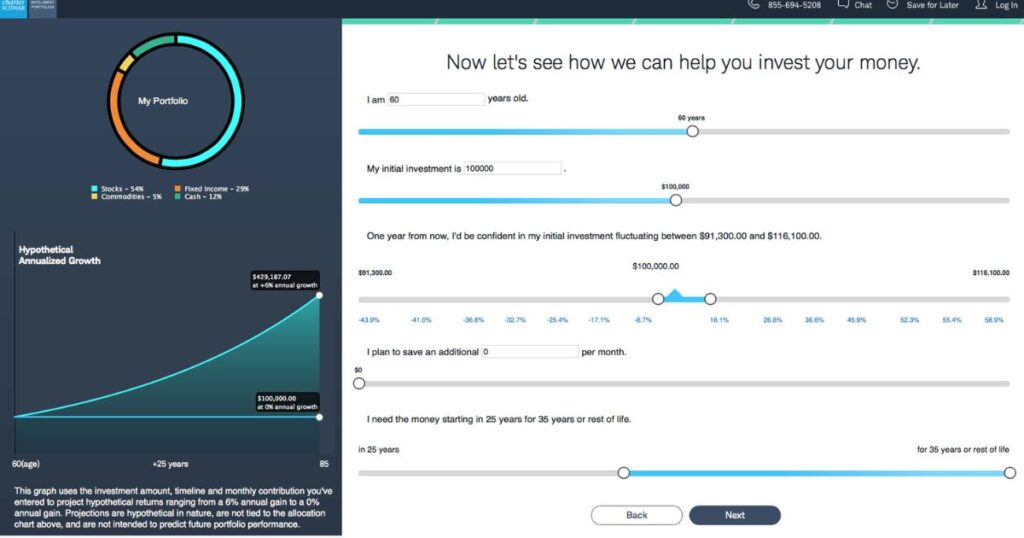

Automated investing platforms, often called robo-advisors, use questionnaires to assess an investor’s risk tolerance and financial goals, then create and manage a tailored portfolio.

This method is particularly appealing to those seeking a hands-off approach to investing or those just starting their investment journey.

While it offers many advantages it’s important for investors to understand the underlying strategies and regularly review their automated investments to ensure they continue to align with their financial objectives.

Before diving into the specifics of automating your Schwab investments it’s essential to understand what automated investing entails and its benefits.

What Is Automated Investing?

Automated investing, also known as robo-investing or algorithmic investing, refers to the use of technology to manage and optimize investment portfolios with minimal human intervention.

This approach typically involves setting up recurring investments, automatic rebalancing, and sometimes using algorithms to make investment decisions based on predetermined criteria.

Benefits of Automated Investing

Automating your investments can offer several advantages:

- Consistency: Regular, automated contributions help maintain a disciplined investment approach.

- Time-saving: Reduces the need for constant monitoring and manual transactions.

- Emotion-free decisions: Helps avoid impulsive buying or selling based on market fluctuations.

- Cost-effective: Often involves lower fees compared to actively managed accounts.

- Diversification: Easier to maintain a balanced, diversified portfolio.

Schwab’s Automated Investing Options

Schwab offers several automated investing options to cater to different investor needs and preferences.

The flagship service is Schwab Intelligent Portfolios, a robo-advisor that creates and manages a diversified portfolio of ETFs based on the investor’s risk profile, with automatic rebalancing and dividend reinvestment.

For those seeking more personalized guidance Schwab Intelligent Portfolios Premium combines automated investing with access to Certified Financial Planner™ professionals.

Investors who prefer more control can use Schwab Automatic Investing to set up recurring investments in their chosen mutual funds and ETFs. Each option has its own features, minimum investment requirements, and fee structures.

Schwab Intelligent Portfolios, for instance, requires a $5,000 minimum investment but charges no advisory fees, while Schwab Intelligent Portfolios Premium has a $25,000 minimum and includes a planning fee and monthly advisory fee.

These varied options allow investors to choose the level of automation and professional involvement that best suits their investment style and financial goals.

Schwab offers several ways to automate your investing process. Let’s explore the main options available:

Schwab Intelligent Portfolios

Schwab Intelligent Portfolios is the company’s robo-advisor service, providing a fully automated investment management solution.

How it works?

- Complete an online questionnaire about your financial goals and risk tolerance.

- Schwab’s algorithm creates a diversified portfolio of ETFs tailored to your profile.

- The system automatically rebalances your portfolio and reinvests dividends.

- Minimum investment: $5,000

Key features

- No advisory fees, commissions, or account service fees

- Tax-loss harvesting for accounts over $50,000

- Automatic rebalancing

- 24/7 professional monitoring

Schwab Intelligent Portfolios Premium

This service combines the automated features of Schwab Intelligent Portfolios with personalized guidance from a Certified Financial Planner™ professional.

How it works?

- Includes all features of Schwab Intelligent Portfolios

- Provides unlimited 1:1 guidance from a CFP® professional

- Helps create a comprehensive financial plan

Key features:

- $25,000 minimum investment

- $300 one-time planning fee and $30/month advisory fee

- Personalized advice on various financial topics

Schwab Automatic Investing

For those who prefer more control over their investment choices, Schwab Automatic Investing allows you to set up recurring investments in mutual funds and ETFs.

How it works?

- Choose the mutual funds or ETFs you want to invest in regularly

- Set up automatic transfers from your linked bank account

- Determine the frequency and amount of your investments

Key features:

- No minimum investment required

- Flexibility to choose your own investments

- Can be used for both taxable and retirement accounts

Read This Blog: Are Condos A Good Investment?

Steps to Automate Your Schwab Investments

To automate your Schwab investments, start by assessing your financial goals and risk tolerance.

Then, choose the automated investing method that best suits your needs. Schwab Intelligent Portfolios, Schwab Intelligent Portfolios Premium, or Schwab Automatic Investing.

Open a Schwab account if you don’t have one, or link your existing account to the chosen service. Set up your automated investments by completing the required questionnaires or selecting your preferred funds and investment schedule.

Link your bank account to fund your investments, ensuring you’ve set up automatic transfers.

While automation reduces the need for constant oversight, it’s important to periodically monitor your investments and adjust your strategy if your financial circumstances or goals change.

This process allows you to leverage Schwab’s tools to create a consistent, disciplined investment approach tailored to your individual needs.

Now that we’ve covered the main automated investing options at Schwab, let’s walk through the steps to set up automated investing:

Assess Your Financial Goals And Risk Tolerance

Before automating your investments, it’s crucial to:

- Define your financial goals for example retirement, buying a house, funding education

- Determine your investment timeline

- Assess your risk tolerance

This information will help you choose the most appropriate automated investing option and portfolio allocation.

Choose Your Automated Investing Method

Based on your goals, risk tolerance, and desired level of involvement, select one of Schwab’s automated investing options:

- Schwab Intelligent Portfolios for a hands-off approach

- Schwab Intelligent Portfolios Premium for automated investing with professional guidance

- Schwab Automatic Investing for more control over investment selections

Open Or Link Your Schwab Account

If you don’t already have a Schwab account, you’ll need to open one. If you have an existing account, you may need to link it to the automated investing service you’ve chosen.

Set Up Your Automated Investments

The setup process will vary depending on the option you’ve chosen:

For Schwab Intelligent Portfolios

- Complete the online questionnaire

- Review and approve your recommended portfolio

- Fund your account

For Schwab Intelligent Portfolios Premium

Schwab Intelligent Portfolios Premium offers a hybrid approach to automated investing, combining the efficiency of robo-advisory services with personalized guidance from human financial experts.

This service is designed for investors who want the benefits of automated portfolio management but also desire professional insights and comprehensive financial planning.

With Schwab Intelligent Portfolios Premium clients get access to all the features of the standard Intelligent Portfolios service, including automated portfolio construction, rebalancing, and tax-loss harvesting.

They receive unlimited one-on-one guidance from Certified Financial Planner™ professionals. This combination allows investors to address more complex financial situations and receive tailored advice on various aspects of their financial life, beyond just investment management.

The service requires a higher minimum investment than the standard offering and includes both a one-time planning fee and an ongoing monthly advisory fee.

- Follow the steps for Schwab Intelligent Portfolios

- Schedule your initial consultation with a CFP® professional

Read This Blog: Why Should Georgia Invest Into Different Airport Locations?

For Schwab Automatic Investing

- Log into your Schwab account

- Navigate to the “Trade” tab and select “Automatic Investing”

- Choose your mutual funds or ETFs

- Set up your investment schedule and amounts

Link Your Bank Account

To fund your automated investments, you’ll need to link your bank account to your Schwab account:

- Provide your bank account information

- Verify the account through small test deposits

- Set up automatic transfers to fund your investments

Monitor And Adjust as Needed

While automated investing reduces the need for constant oversight, it’s still important to:

- Regularly review your investment performance

- Adjust your strategy if your financial goals or circumstances change

- Stay informed about any changes to Schwab’s automated investing services

Best Practices For Automated Investing With Schwab

When automating your investments with Schwab several best practices can help optimize your strategy. Start early and invest consistently to harness the power of compound interest and dollar-cost averaging.

Ensure your portfolio is well-diversified across various asset classes and sectors, whether using Schwab Intelligent Portfolios or selecting your own investments.

Take advantage of tax-advantaged accounts like IRAs or 401(k)s to potentially reduce your tax liability. Regularly review and rebalance your portfolio, especially if you’re using Schwab Automatic Investing, to maintain your desired asset allocation.

Stay informed about market trends and economic news, but avoid making impulsive changes based on short-term market fluctuations.

Consider your long-term financial goals when setting up your automated investments, and be prepared to adjust your strategy as your circumstances change.

Lastly, while automation simplifies investing, it’s still beneficial to educate yourself about financial markets and occasionally seek professional advice to ensure your strategy remains aligned with your goals.

To make the most of your automated investing strategy with Schwab, consider these best practices:

Start Early And Invest Consistently

The power of compound interest makes it beneficial to start investing as early as possible. Set up regular contributions, even if they’re small, to take advantage of dollar-cost averaging.

Diversify Your Investments

Whether you’re using Schwab Intelligent Portfolios or choosing your own investments, ensure your portfolio is well-diversified across different asset classes and sectors.

Take Advantage Of Tax-Advantaged Accounts

Consider using tax-advantaged accounts like IRAs or 401(k)s for your automated investments to potentially reduce your tax liability.

Regularly Review And Rebalance

While Schwab Intelligent Portfolios automatically rebalances your investments, if you’re using Schwab Automatic Investing, make sure to periodically review and rebalance your portfolio to maintain your desired asset allocation.

Stay Informed But Avoid Overreacting

Keep yourself informed about market trends and economic news, but avoid making impulsive changes to your automated investment strategy based on short-term market fluctuations.

Frequently Asked Questions

Is there a minimum investment required for Schwab’s automated investing options?

Schwab Intelligent Portfolios requires a $5,000 minimum, while Schwab Intelligent Portfolios Premium requires $25,000. Schwab Automatic Investing has no minimum.

Can I customize my portfolio in Schwab Intelligent Portfolios?

While you can’t choose individual investments, you can adjust your risk profile, which will alter the portfolio allocation.

Are there fees associated with Schwab’s automated investing services?

Schwab Intelligent Portfolios has no advisory fees, but Schwab Intelligent Portfolios Premium charges a one-time planning fee and monthly advisory fee.

Can I use Schwab’s automated investing for both taxable and retirement accounts?

Yes, Schwab’s automated investing options can be used for both taxable and various types of retirement accounts.

How often does Schwab rebalance automated portfolios?

Schwab Intelligent Portfolios monitors portfolios daily and rebalances when allocations drift significantly from their targets.

Final Words

Automating your investments with Schwab can be an effective way to maintain a consistent investment strategy, save time, and potentially improve your long-term financial outcomes.

Whether you opt for the fully automated Schwab Intelligent Portfolios, the hybrid approach of Schwab Intelligent Portfolios Premium, or the more flexible Schwab Automatic Investing, there’s an option to suit various investment styles and preferences.

By following the steps outlined in this guide and adhering to best practices, you can set up an automated investment strategy that aligns with your financial goals and risk tolerance.

Marcus Delgado is a certified financial planner with expertise in retirement strategies and tax optimization.

With a background in economics and a passion for helping individuals achieve financial freedom, Marcus provides practical advice on long-term wealth building and smart money management.