Financial wisdom refers to making smart and informed decisions about managing money and investments. It helps individuals build stability and achieve long-term financial goals.

Exploring Newssyc.in’s Financial Blog can offer key insights into effective money management. It’s a guide for those seeking to enhance their financial knowledge and make better choices.

The Newssyc.in financial blog covers topics like budgeting, investing, and savings strategies. It provides valuable tips for both beginners and seasoned investors, helping readers stay updated with the latest financial trends. The blog serves as a resource for achieving financial independence.

What Is newssyc.in/blog/category/financial?

Newssyc.in/blog/category/financial is a comprehensive financial resource. It offers valuable insights on various money-related topics. The blog caters to readers of all financial knowledge levels. From beginners to experienced investors, everyone can find useful information here.

The financial category covers a wide range of subjects. It includes articles on personal finance, investing, and money management. Readers can find practical advice on budgeting and saving. The blog also offers tips on wealth creation and financial planning.

Each article is written in a clear, easy-to-understand style. Complex financial concepts are broken down into digestible pieces. This approach makes financial literacy accessible to all readers. The blog is regularly updated with fresh content.

Newssyc.in strives to be a reliable source of financial information. It aims to empower readers to make informed decisions about their money. The blog encourages financial literacy and smart money management.

Importance Of Financial Wisdom In Today’s World

Financial wisdom is crucial in our complex economic landscape. It helps individuals navigate the intricate world of personal finance. With proper financial knowledge, people can make better decisions about their money. This wisdom is essential for financial security and independence.

In today’s fast-paced world, financial markets are constantly evolving. New financial products and services emerge regularly. Without financial wisdom, it’s easy to feel overwhelmed. Understanding these changes is key to making informed choices.

Financial wisdom enables effective budget management. It helps in creating and sticking to financial goals. This knowledge is vital for both short-term and long-term financial planning. It aids in making smart decisions about spending, saving, and investing.

In uncertain economic times, financial wisdom becomes even more important. It provides a foundation for financial stability. Those with financial knowledge are better equipped to handle economic downturns. They can make more resilient financial plans.

Financial wisdom also contributes to overall well-being. It reduces stress related to money matters. When people understand their finances, they feel more in control. This leads to improved mental and emotional health.

For younger generations, early financial education is crucial. It sets the stage for a lifetime of good financial habits. Young adults with financial wisdom are better prepared for future challenges. They can make smarter decisions about education, career, and lifestyle choices.

Read This Blog: Where To Invest In 2024?

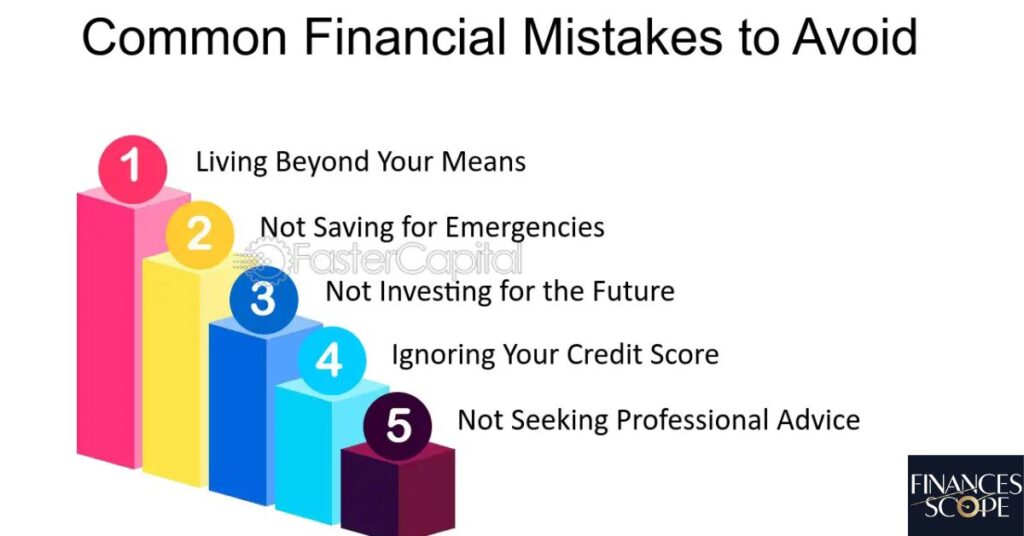

Common Financial Mistakes and How to Avoid Them?

Many people make common financial mistakes that can be easily avoided. One frequent error is living beyond one’s means. This often leads to accumulating debt and financial stress. To avoid this, create a realistic budget and stick to it.

Neglecting emergency savings is another common mistake. Unexpected expenses can derail financial plans. Set aside a portion of your income for emergencies. Aim for 3-6 months of living expenses in your emergency fund.

Many individuals fail to start investing early. This mistake costs them valuable time for compound interest to work. Begin investing as soon as possible, even with small amounts. Time in the market is often more important than timing the market.

Ignoring retirement planning is a critical error. It’s never too early to start saving for retirement. Take advantage of employer-sponsored retirement plans. Consider additional retirement savings vehicles like IRAs.

Overspending on credit cards is a common pitfall. High-interest credit card debt can quickly spiral out of control. Use credit cards responsibly and pay off balances in full each month. If you have credit card debt, prioritize paying it off.

Many people make the mistake of not tracking their spending. This leads to financial blind spots and overspending. Keep a detailed record of all expenses. Use budgeting apps or spreadsheets to stay on top of your finances.

Failing to set financial goals is another common error. Without clear goals, it’s easy to lose direction. Set specific, measurable, achievable, relevant, and time-bound (SMART) financial goals. Review and adjust these goals regularly.

Strategies For Achieving Financial Stability

Achieving financial stability requires a combination of smart strategies. Start by creating a comprehensive budget. Track all income and expenses. This gives you a clear picture of your financial situation.

Build an emergency fund as a top priority. Aim to save 3-6 months of living expenses. This fund provides a safety net for unexpected costs or income loss. Keep this money in an easily accessible savings account.

Pay off high-interest debt aggressively. Focus on credit card balances and personal loans first. Consider the debt avalanche or debt snowball method for effective debt reduction. Becoming debt-free is a crucial step towards financial stability.

Live below your means to increase savings and investment potential. Identify areas where you can cut back on expenses. Redirect the saved money towards your financial goals. This habit builds a strong foundation for long-term financial health.

Increase your income streams whenever possible. Consider side hustles or freelance work. Diversifying income sources provides additional financial security. It also accelerates progress towards your financial goals.

Invest regularly and wisely. Start with low-cost index funds if you’re a beginner. As you gain knowledge, diversify your investment portfolio. Consider seeking advice from a financial advisor for personalized strategies.

Continuously educate yourself about personal finance. Stay informed about financial markets and economic trends. This knowledge helps you make better financial decisions. It also prepares you for changing economic conditions.

Investing 101: Tips For Beginners

Investing is crucial for long-term financial growth. Start by understanding your risk tolerance. This helps determine the right investment mix for you. Consider factors like age, financial goals, and comfort with market fluctuations.

Begin with low-cost index funds or ETFs. These offer broad market exposure with minimal fees. They’re an excellent way for beginners to start investing. As you gain knowledge, you can explore more specific investment options.

Diversify your investment portfolio. Don’t put all your eggs in one basket. Spread investments across different asset classes and sectors. This helps manage risk and potentially improve returns over time.

Start investing early to take advantage of compound interest. Even small amounts invested regularly can grow significantly over time. The power of compounding is one of the most valuable tools for building wealth.

Educate yourself about different investment options. Learn about stocks, bonds, mutual funds, and real estate. Understanding these options helps you make informed investment decisions. Consider taking an online course or reading investment books.

Set clear investment goals. Are you investing for retirement, a home purchase, or education? Your goals will influence your investment strategy. They also help you stay focused during market fluctuations.

Regularly contribute to your investments. Consider setting up automatic monthly contributions. This strategy, known as dollar-cost averaging, can help smooth out market volatility. It also enforces disciplined investing habits.

Read This Blog: How To Earn Rs 500 From The Stock Market Daily?

The Role Of Budgeting In Financial Management

Budgeting is a cornerstone of effective financial management. It provides a clear picture of your income and expenses. A well-planned budget helps you allocate resources efficiently. It’s the foundation for achieving your financial goals.

Start by tracking all income and expenses. This gives you a realistic view of your financial situation. Use apps or spreadsheets to make tracking easier. Be thorough and honest in your tracking for the most accurate results.

Categorize your expenses into fixed and variable costs. Fixed costs include rent, loan payments, and utilities. Variable costs include groceries, entertainment, and discretionary spending. This categorization helps identify areas for potential savings.

Set financial goals and incorporate them into your budget. Whether it’s saving for a vacation or paying off debt, your budget should reflect these goals. Allocate specific amounts to each goal in your monthly budget.

Create a realistic budget that you can stick to. Overly restrictive budgets often fail. Allow some flexibility for unexpected expenses or small indulgences. The key is finding a balance between discipline and practicality.

Review and adjust your budget regularly. Your financial situation and goals may change over time. Monthly budget reviews help you stay on track. Make adjustments as needed to ensure your budget remains relevant and effective.

Use the 50/30/20 rule as a starting point. Allocate 50% of income to needs, 30% to wants, and 20% to savings and debt repayment. This rule provides a simple framework for balanced budgeting. Adjust the percentages based on your specific situation.

Resources For Learning More About Financial Wisdom

Numerous resources are available for enhancing your financial knowledge. Books are an excellent starting point. “Rich Dad Poor Dad” by Robert Kiyosaki is a popular choice. It offers insights on financial mindset and investing.

Online courses provide structured learning experiences. Platforms like Coursera and edX offer financial courses from top universities. Many of these courses are free or low-cost. They cover topics from basic budgeting to advanced investing strategies.

Financial podcasts are great for learning on the go. “Planet Money” from NPR offers engaging economic stories. “The Dave Ramsey Show” focuses on debt reduction and personal finance. Choose podcasts that align with your financial interests and goals.

Personal finance blogs offer a wealth of information. Websites like NerdWallet and The Motley Fool provide articles on various financial topics. They often offer calculators and tools for financial planning. Regular reading of these blogs can enhance your financial literacy.

Government websites like Investor.gov provide reliable financial education resources. They offer unbiased information on investing and financial planning. These sites are particularly useful for understanding financial regulations and consumer protections.

Financial advisors can offer personalized guidance. Consider meeting with a certified financial planner. They can help create a comprehensive financial plan tailored to your needs. Look for advisors who are fiduciaries and have relevant certifications.

Frequently Asked Questions

What is the first step to improving my financial situation?

The first step is creating a comprehensive budget. Track your income and expenses to understand your financial picture.

How much should I save for emergencies?

Aim to save 3-6 months of living expenses in an easily accessible emergency fund.

Is it too late to start investing if I’m in my 40s?

It’s never too late to start investing. Begin now and focus on maximizing your contributions to catch up.

How can I reduce my credit card debt?

Focus on paying off high-interest debt first. Consider balance transfer options and create a repayment plan.

What’s the best way to teach children about money?

Start early with age-appropriate lessons. Use practical examples and involve them in family financial discussions.

Conclusion:

Financial wisdom is essential for navigating today’s complex economic landscape. By understanding key concepts, avoiding common mistakes, and implementing effective strategies, you can achieve financial stability and security. Remember, financial education is an ongoing process.

Continuously seek knowledge, stay informed about market trends, and regularly review your financial plans. With dedication and smart decision-making, you can build a strong financial foundation for yourself and your family. Start your journey towards financial wisdom today, and embrace the path to long-term financial success.

Marcus Delgado is a certified financial planner with expertise in retirement strategies and tax optimization.

With a background in economics and a passion for helping individuals achieve financial freedom, Marcus provides practical advice on long-term wealth building and smart money management.