Universities across the globe are increasingly looking towards Israel as a promising destination for investment.

This trend is driven by Israel’s reputation as a hub for innovation, technology, and ground breaking research.

As institutions of higher learning seek to diversify their portfolios and align their investments with cutting-edge advancements, Israel’s thriving startup ecosystem and academic prowess make it an attractive option for university endowments and partnerships.

The Innovation Ecosystem Of Israel

Israel, often referred to as the Start-Up Nation has cultivated a unique ecosystem that fosters innovation and entrepreneurship.

This environment is particularly appealing to universities looking to invest in forward-thinking ventures and research.

The Start-Up Nation Phenomenon

Israel’s reputation as the Start-Up Nation is well-earned and continues to attract global attention, including from universities seeking investment opportunities:

- Density of Start-Ups: Israel boasts the highest density of start-ups per capita in the world, creating a vibrant ecosystem for innovation and entrepreneurship.

- Culture of Innovation: The Israeli culture encourages risk-taking, creativity, and out-of-the-box thinking, which aligns well with academic pursuits of knowledge and discovery.

- Government Support: The Israeli government provides substantial support for R&D and start-ups through grants, tax incentives, and incubator programs.

- Military Technology Transfer: Many innovations stem from technologies developed in the Israeli military, particularly in cybersecurity and communications.

- Global Connections: Israeli start-ups often have a global outlook from inception, making them attractive for international university partnerships and investments.

Key Sectors Driving Innovation

Several key sectors in Israel are at the forefront of global innovation, making them particularly attractive for university investments:

- Cybersecurity: Israel is a world leader in cybersecurity, with many cutting-edge companies emerging from military intelligence units.

- Artificial Intelligence and Machine Learning: Israeli companies are making significant strides in AI applications across various industries.

- Biotechnology and Medical Devices: Israel’s healthcare innovation sector is robust, with breakthroughs in pharmaceuticals, medical devices, and digital health.

- Water Technology: Given its arid climate, Israel has become a pioneer in water conservation and desalination technologies.

- Agritech: Israeli innovations in agriculture, from drip irrigation to pest control, continue to revolutionize farming practices globally.

Research And Development Intensity

Israel’s commitment to research and development is a key factor in its appeal to university investors:

- R&D Spending: Israel consistently ranks among the top countries in the world for R&D spending as a percentage of GDP.

- Academic-Industry Collaboration: There’s a strong tradition of collaboration between Israeli universities and industry, facilitating the commercialization of academic research.

- Technology Transfer Offices: Israeli universities have well-established technology transfer offices that effectively bridge academic research with commercial applications.

- Publication Impact: Israeli researchers consistently produce high-impact publications across various scientific fields.

- International Collaborations: Israeli institutions actively engage in international research collaborations, enhancing their global relevance and impact.

Academic Excellence And Research Opportunities

Universities invest in Israel not just for financial returns but also for the rich academic and research opportunities the country offers.

World-Class Universities And Research Institutions

Israel is home to several globally recognized universities and research institutions:

- Technion – Israel Institute of Technology: Known for its excellence in engineering and computer science.

- Weizmann Institute of Science: A world-renowned center for natural and exact sciences research.

- Hebrew University of Jerusalem: Consistently ranked among the top universities globally, with strengths across multiple disciplines.

- Tel Aviv University: Known for its interdisciplinary approach and strong programs in fields like management and social sciences.

- Ben-Gurion University of the Negev: A leader in desert research and environmental studies.

Collaborative Research Opportunities

Investing in Israel opens doors for collaborative research opportunities:

- Joint Research Programs: Many universities establish joint research programs with Israeli institutions, fostering knowledge exchange and innovation.

- Student Exchange Programs: Investments often come with opportunities for student exchanges, enriching the global perspective of participating universities.

- Access to Unique Resources: Israel offers access to unique research environments, from the Dead Sea to advanced technological facilities.

- Interdisciplinary Collaborations: Israeli institutions are known for their interdisciplinary approach, encouraging cross-pollination of ideas.

- Industry Partnerships: Collaborations often extend beyond academia to include industry partners, providing real-world applications for research.

Technological Advancements And Knowledge Transfer

Investments in Israel can facilitate technological advancements and knowledge transfer:

- Technology Licensing: Universities can gain access to cutting-edge technologies developed in Israeli institutions.

- Start-Up Incubators: Some universities invest in or partner with Israeli start-up incubators, gaining early access to innovative ideas.

- Faculty Exchange Programs: These programs allow for the exchange of expertise and teaching methodologies.

- Research Commercialization: Israeli expertise in turning academic research into commercial products can benefit investing universities.

- Innovation Workshops and Seminars: Regular interactions through workshops and seminars facilitate ongoing knowledge transfer.

Read This Blog: Where To Invest In 2024?

Financial Considerations For University Investments

While academic and research opportunities are crucial, financial considerations play a significant role in university investment decisions regarding Israel.

Potential For High Returns

Israel’s dynamic economy and innovative sectors offer potential for high investment returns:

- Successful Exits: Israeli start-ups have a track record of successful exits through acquisitions or IPOs, potentially yielding significant returns.

- Venture Capital Opportunities: Universities can invest in Israeli venture capital funds, gaining exposure to a portfolio of promising start-ups.

- Technology Licensing Revenue: Investments in research can lead to lucrative technology licensing agreements.

- Real Estate Appreciation: Investments in Israeli real estate, particularly in tech hubs, can offer steady appreciation.

- Currency Diversification: Investing in Israel provides exposure to the Israeli Shekel, potentially offering currency diversification benefits.

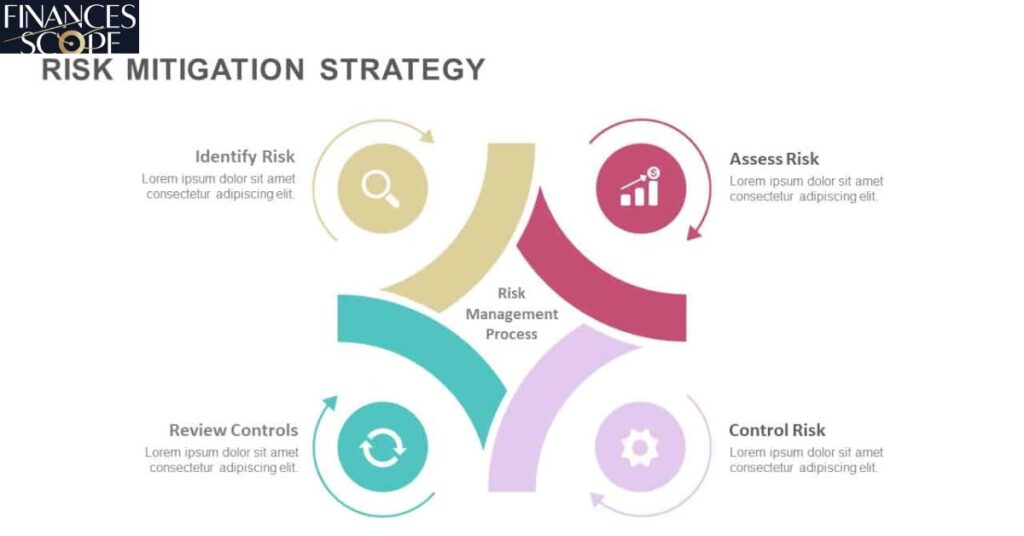

Risk Mitigation Strategies

Universities employ various strategies to mitigate risks associated with investing in Israel:

- Diversified Portfolios: Investments are typically part of a diversified portfolio to spread risk.

- Due Diligence: Rigorous due diligence processes are employed to assess potential investments.

- Partnerships with Local Entities: Many universities partner with local Israeli institutions or investment firms to leverage local expertise.

- Focus on Established Sectors: Investments often target Israel’s more established and proven sectors, such as cybersecurity or biotech.

- Staged Investments: Some universities opt for staged investments, increasing their commitment as they gain more experience in the market.

Ethical Considerations And Transparency

Universities must navigate ethical considerations and maintain transparency in their Israeli investments:

- Stakeholder Communication: Clear communication with university stakeholders about the nature and purpose of Israeli investments is crucial.

- Alignment with University Values: Investments are typically aligned with the university’s mission and values.

- Ethical Investment Policies: Many universities have ethical investment policies that guide their decisions, including those related to Israel.

- Addressing Political Sensitivities: Given the complex political situation in the region, universities often need to address concerns from various stakeholders.

- Regular Reporting: Transparent reporting on the performance and impact of Israeli investments helps maintain trust and support.

Read This Blog: What Is An Investment Policy Statement?

Geopolitical And Cultural Factors

Investing in Israel requires consideration of various geopolitical and cultural factors that can impact both the risks and opportunities associated with these investments.

Israel’s Geopolitical Position

Israel’s unique geopolitical situation influences investment decisions:

- Regional Instability: The ongoing conflicts and tensions in the Middle East can create uncertainty for investors.

- Resilient Economy: Despite regional challenges, Israel’s economy has shown remarkable resilience.

- International Relations: Israel’s diplomatic relationships, including recent normalization agreements with some Arab states, can open new opportunities.

- Global Partnerships: Israel’s strong ties with countries like the United States can provide additional layers of economic stability.

- Strategic Importance: Israel’s strategic importance in areas like cybersecurity and defense technology can be attractive for certain university investments.

Cultural Dynamics And Diversity

Israel’s diverse cultural landscape can offer unique perspectives and opportunities:

- Multicultural Society: Israel’s diverse population brings together various cultural perspectives, fostering creativity and innovation.

- Global Outlook: Many Israelis have international experience, facilitating easier collaboration with global partners.

- Entrepreneurial Spirit: The cultural emphasis on entrepreneurship aligns well with university goals of fostering innovation.

- Language Accessibility: The widespread use of English in Israeli academia and business eases communication for international partners.

- Academic Freedom: Israel’s commitment to academic freedom is an important factor for universities considering investments or partnerships.

Navigating Political Sensitivities

Universities must carefully navigate the political sensitivities associated with investing in Israel:

- Diverse Stakeholder Views: Universities often face diverse and sometimes conflicting views from students, faculty, and donors regarding Israeli investments.

- Boycott, Divestment, and Sanctions (BDS) Movement: Some universities face pressure from the BDS movement to divest from Israel.

- Balancing Act: Institutions must balance the potential benefits of Israeli investments with the need to maintain inclusivity and respect for diverse perspectives on campus.

- Transparent Decision-Making: Clear communication about the rationale behind Israeli investments can help mitigate controversies.

- Focus on Mutual Benefit: Emphasizing how investments in Israel can benefit both the university and broader society can help garner support.

Frequently Asked Questions

Are university investments in Israel controversial?

While some investments can be controversial due to political sensitivities, many universities find valuable opportunities in Israel’s innovation ecosystem.

What types of Israeli ventures do universities typically invest in?

Universities often focus on tech start-ups, research collaborations, and venture capital funds in sectors like cybersecurity, biotech, and AI.

How do universities balance financial returns with ethical considerations?

Many universities have ethical investment policies and engage in stakeholder consultations to ensure investments align with institutional values.

Can investing in Israel benefit university research programs?

Yes, investments often come with opportunities for research collaborations, technology transfer, and access to cutting-edge innovations.

How do geopolitical factors affect university investments in Israel?

While geopolitical tensions can create challenges, many universities find that Israel’s resilient economy and innovation ecosystem outweigh these concerns.

Conclusion

Universities invest in Israel for a multitude of reasons, ranging from financial opportunities to academic collaborations and access to cutting-edge research and innovation.

Israel’s reputation as the Start-Up Nation coupled with its world-class academic institutions and focus on R&D, makes it an attractive destination for university investments.

The potential for high returns in sectors like technology, cybersecurity, and biotechnology is a significant draw. Equally important are the opportunities for knowledge exchange collaborative research, and exposure to a unique innovation ecosystem.

These investments often extend beyond mere financial transactions, fostering deep academic partnerships that benefit both the investing universities and Israeli institutions.

Marcus Delgado is a certified financial planner with expertise in retirement strategies and tax optimization.

With a background in economics and a passion for helping individuals achieve financial freedom, Marcus provides practical advice on long-term wealth building and smart money management.