As we navigate the complex financial landscape of 2024 investors are faced with a myriad of options and challenges.

The global economy continues to evolve, influenced by technological advancements, geopolitical shifts, and changing consumer behaviors.

This article explores promising investment opportunities for 2024, considering various asset classes, emerging trends, and potential risks.

Understanding The 2024 Investment Landscape

Before delving into specific investment opportunities it’s crucial to understand the broader economic and market context of 2024. This foundation will help inform more targeted investment decisions.

Global Economic Outlook

The global economy in 2024 is characterized by a mix of recovery and ongoing challenges. Following the turbulent years of the early 2020s, many economies have shown resilience and adaptability. However, the landscape remains complex:

Inflation Concerns: While central banks have made progress in controlling inflation, it remains a key concern for investors and policymakers alike. The impact of previous monetary tightening measures continues to ripple through economies.

Technological Disruption: The rapid pace of technological advancement, particularly in areas like artificial intelligence, renewable energy, and biotechnology, is reshaping industries and creating new investment opportunities.

Geopolitical Tensions: Ongoing geopolitical issues, including trade disputes and regional conflicts, continue to influence global markets and supply chains.

Climate Change Impact: The increasing focus on climate change and sustainability is driving shifts in government policies, consumer behavior, and corporate strategies.

Demographic Shifts: Aging populations in developed countries and growing middle classes in emerging markets are influencing economic trends and investment patterns.

Market Trends And Investor Sentiment

As we move through 2024, several key market trends and shifts in investor sentiment are apparent:

Emphasis on Quality: After periods of market volatility, many investors are prioritizing quality assets with strong fundamentals and stable cash flows.

Diversification Beyond Traditional Assets: There’s growing interest in alternative investments and non-traditional asset classes as investors seek to diversify their portfolios.

ESG Integration: Environmental, Social, and Governance (ESG) factors are increasingly influencing investment decisions across all asset classes.

Digital Assets Maturation: The cryptocurrency and digital asset market has continued to evolve, with clearer regulations and increased institutional adoption.

Focus on Income Generation: With ongoing economic uncertainties, many investors are prioritizing investments that offer reliable income streams.

Promising Sectors For Investment In 2024

Several sectors stand out as potentially attractive for investors in 2024, driven by technological advancements, changing consumer behaviors, and global trends.

Technology And Innovation

The technology sector continues to offer compelling investment opportunities in 2024:

Artificial Intelligence and Machine Learning: Companies developing and implementing AI solutions across various industries remain at the forefront of innovation.

Cybersecurity: As digital threats evolve, businesses specializing in cybersecurity solutions are seeing increased demand.

Cloud Computing and Edge Computing: The ongoing digital transformation of businesses is driving growth in cloud services and edge computing technologies.

5G and Internet of Things (IoT): The rollout of 5G networks and the proliferation of IoT devices are creating new investment opportunities in hardware, software, and services.

Quantum Computing: While still in its early stages, quantum computing is attracting significant investment and has the potential to revolutionize various industries.

Healthcare And Biotechnology

The healthcare sector continues to offer attractive investment opportunities, driven by demographic trends, technological advancements, and ongoing health concerns:

Personalized Medicine: Companies focusing on genomics and personalized treatment approaches are seeing increased interest.

Digital Health: Telemedicine, remote patient monitoring, and health data analytics companies are experiencing growth.

Biotechnology: Firms developing innovative treatments, particularly in areas like gene therapy and immunotherapy, remain attractive.

Medical Devices: Companies producing advanced medical devices, particularly those incorporating AI and IoT technologies, offer potential.

Healthcare IT: Businesses providing software solutions for healthcare management and data analysis are seeing increased demand.

Read This Blog: What Are Specified Investment Products?

Renewable Energy And Sustainability

With the growing focus on climate change and sustainability, the renewable energy sector presents numerous investment opportunities:

Solar and Wind Energy: Companies involved in the production and installation of solar panels and wind turbines continue to see growth.

Energy Storage: As renewable energy adoption increases, businesses specializing in energy storage solutions are becoming more critical.

Electric Vehicles and Battery Technology: The ongoing shift towards electric vehicles is creating opportunities in both vehicle manufacturing and battery technology.

Green Hydrogen: Companies involved in the production and distribution of green hydrogen are attracting increased attention.

Sustainable Agriculture: Businesses focusing on sustainable farming practices and alternative protein sources are seeing growing interest.

Financial Technology (FinTech)

The financial technology sector continues to disrupt traditional financial services and offer new investment opportunities:

Digital Payment Solutions: Companies providing innovative payment technologies and platforms are seeing continued growth.

Blockchain and Decentralized Finance (DeFi): While still evolving, blockchain technology and DeFi platforms are attracting significant interest and investment.

Robo-Advisors and AI-Driven Financial Services: Firms offering automated investment services and AI-powered financial analysis tools are gaining traction.

Insurtech: Companies leveraging technology to innovate in the insurance industry are seeing increased adoption.

Regtech: Businesses providing technology solutions for regulatory compliance are becoming increasingly important as financial regulations evolve.

Alternative Investment Opportunities

Beyond traditional stocks and bonds, several alternative investment options are gaining attention in 2024.

Real Estate Investment Trusts (REITs)

Real Estate Investment Trusts continue to offer attractive opportunities for investors seeking exposure to the real estate market without direct property ownership:

Industrial REITs: With the continued growth of e-commerce, industrial REITs focusing on logistics and distribution centers remain attractive.

Data Center REITs: The increasing demand for cloud computing and data storage is driving growth in data center REITs.

Healthcare REITs: Properties catering to an aging population, such as senior living facilities and medical offices, offer potential.

Residential REITs: In areas with housing shortages, residential REITs can provide stable income and potential appreciation.

Niche REITs: Specialized REITs focusing on areas like cell towers or self-storage facilities are attracting investor interest.

Commodities

While traditionally volatile, certain commodities are attracting attention in 2024:

Precious Metals: Gold and silver continue to be seen as potential hedges against inflation and economic uncertainty.

Industrial Metals: Metals crucial for renewable energy and electric vehicle production, such as copper and lithium, are in focus.

Agricultural Commodities: With ongoing concerns about food security and climate change impacts, certain agricultural commodities are gaining attention.

Water: As water scarcity becomes a growing concern, investments related to water resources and treatment are attracting interest.

Carbon Credits: With increasing focus on carbon emissions reduction, carbon credit markets are seeing growth.

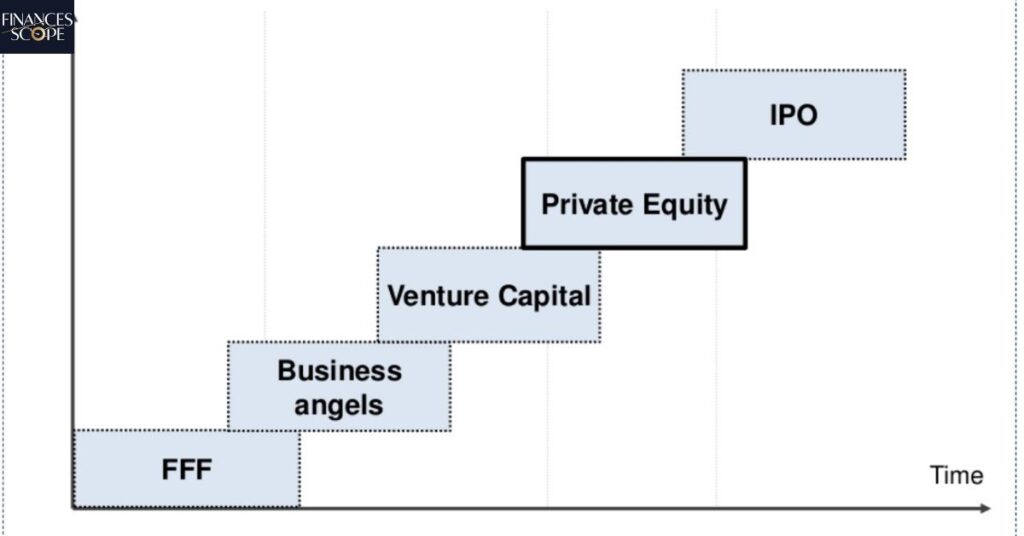

Private Equity And Venture Capital

For accredited investors, private equity and venture capital offer opportunities to invest in companies not available on public markets:

Late-Stage Start-ups: Companies on the brink of going public or being acquired can offer significant potential returns.

Distressed Assets: Opportunities may arise to invest in undervalued companies or assets, particularly in sectors still recovering from economic disruptions.

Impact Investing: Private equity funds focusing on companies with positive social or environmental impacts are gaining traction.

Sector-Specific Funds: Funds specializing in high-growth sectors like technology or healthcare can offer targeted exposure.

Secondary Markets: Investing in pre-existing private equity commitments can provide access to mature portfolios.

Digital Assets

While still considered high-risk, digital assets have continued to evolve and mature:

Established Cryptocurrencies: Bitcoin and Ethereum remain the most well-known and liquid digital assets.

Stablecoins: Digital currencies pegged to stable assets like the US dollar are gaining adoption for transactions and as a store of value.

Security Tokens: Tokenized traditional assets, such as real estate or art, offer new ways to invest in familiar asset classes.

Decentralized Finance (DeFi) Protocols: Platforms offering decentralized lending, borrowing, and trading services are attracting interest.

Non-Fungible Tokens (NFTs): While the initial hype has settled, NFTs continue to offer opportunities in digital art, gaming, and other applications.

Read This Blog: What Is An Investment Policy Statement?

Investment Strategies For 2024

Given the complex and evolving investment landscape of 2024, consider these strategies to optimize your investment approach.

Diversification Across Asset Classes

Balance Traditional and Alternative Investments: Combine stocks and bonds with alternative assets like REITs, commodities, or private equity.

Geographic Diversification: Invest across different regions to mitigate country-specific risks and capture global growth opportunities.

Sector Diversification: Spread investments across various sectors to reduce the impact of sector-specific downturns.

Risk-Level Diversification: Include a mix of conservative, moderate, and aggressive investments based on your risk tolerance.

Time Horizon Diversification: Allocate assets across short-term, medium-term, and long-term investments to balance liquidity needs with growth potential.

Focus On Quality And Value

Prioritize Strong Fundamentals: Look for companies with solid balance sheets, consistent cash flows, and sustainable competitive advantages.

Consider Dividend-Paying Stocks: Companies with a history of stable dividend payments can provide income and potential stability.

Value Investing: Seek out undervalued assets that have potential for appreciation.

Quality Bonds: In the fixed income space, prioritize high-quality corporate and government bonds.

Avoid Chasing Trends: Be cautious of overhyped investments and focus on long-term value rather than short-term market movements.

Incorporate ESG Factors

ESG Integration: Consider environmental, social, and governance factors in your investment decisions across all asset classes.

Thematic ESG Investing: Focus on specific themes like clean energy, sustainable agriculture, or social impact.

ESG ETFs and Mutual Funds: Utilize funds that incorporate ESG criteria for broad exposure to sustainable investments.

Engagement and Impact: Consider investments that allow for shareholder engagement to drive positive change in companies.

Monitor ESG Risks: Be aware of ESG-related risks that could impact the long-term performance of your investments.

Stay Informed And Adaptable

Regular Portfolio Review: Consistently review and rebalance your portfolio to ensure it aligns with your goals and risk tolerance.

Stay Informed: Keep up with global economic trends, policy changes, and technological developments that could impact your investments.

Be Prepared for Volatility: Have a plan for managing market volatility, including maintaining an emergency fund and avoiding emotional decisions.

Consider Professional Advice: Work with financial advisors or use robo-advisory services to help navigate complex investment decisions.

Continuous Learning: Invest in your financial education to make more informed investment decisions.

Frequently Asked Questions

Is it a good time to invest in the stock market in 2024?

While timing the market is challenging, a long-term, diversified approach to stock market investing can be appropriate for many investors.

How can I protect my investments against inflation?

Consider inflation-protected securities, real estate investments, and stocks of companies with pricing power.

Are cryptocurrencies a safe investment in 2024?

Cryptocurrencies remain highly volatile; only invest what you can afford to lose and consider them as part of a diversified portfolio.

What are the best international markets to invest in for 2024?

Emerging markets in Asia and select developed markets with strong innovation sectors may offer opportunities, but thorough research is crucial.

How important is ESG investing in 2024?

ESG factors are increasingly important for risk management and identifying growth opportunities across various sectors.

Conclusion

Investing in 2024 presents both exciting opportunities and notable challenges. The global economy continues to evolve, driven by technological advancements, demographic shifts, and increasing focus on sustainability.

While sectors like technology, healthcare, and renewable energy offer promising prospects, it’s crucial to approach investing with a well-diversified long-term strategy.

Successful investing in 2024 requires a balanced approach that considers both traditional and alternative asset classes, incorporates ESG factors, and remains adaptable to changing market conditions.

By staying informed, focusing on quality investments and aligning your portfolio with your personal financial goals and risk tolerance, you can navigate the complex investment landscape of 2024 and beyond.

Marcus Delgado is a certified financial planner with expertise in retirement strategies and tax optimization.

With a background in economics and a passion for helping individuals achieve financial freedom, Marcus provides practical advice on long-term wealth building and smart money management.