In the world of investment and taxation various structures and entities exist to help investors manage their portfolios efficiently.

One such structure that has gained prominence, particularly in New Zealand, is the Portfolio Investment Entity (PIE).

This article aims to provide a comprehensive understanding of PIEs, their characteristics, benefits, and implications for investors and the broader financial landscape.

Definition And Basic Concept

A Portfolio Investment Entity (PIE) is a type of investment vehicle in New Zealand’s tax system. It allows investors to pool their money together for investment purposes while potentially benefiting from lower tax rates on investment income.

PIEs can include managed funds, superannuation schemes, and certain company structures. The key feature of a PIE is that it pays tax on behalf of its investors at their prescribed investor rate (PIR), which is often lower than their personal income tax rate.

This structure aims to encourage saving and investment by offering tax advantages. PIEs must meet specific criteria set by the Inland Revenue Department, including diversification requirements and restrictions on investor influence over investment decisions.

This system simplifies tax obligations for investors and can provide more favorable tax treatment on investment returns.

What is a Portfolio Investment Entity?

A Portfolio Investment Entity (PIE) is a type of investment vehicle introduced in New Zealand in 2007. It is designed to encourage savings and investment by offering tax advantages to investors.

PIEs are typically managed funds that pool money from multiple investors to invest in a diverse range of assets.

Key Characteristics of PIEs

PIEs have several distinguishing features:

- Tax-efficient structure

- Professional management

- Diversified investment portfolio

- Prescribed investor rates for taxation

- Regular reporting and transparency

Types Of PIEs

There are different types of PIEs to suit various investment needs:

- Multi-rate PIEs

- Listed PIEs

- Benefit fund PIEs

- Life fund PIEs

How PIE’s Work

Portfolio Investment Entities (PIEs) operate by pooling investors’ funds and investing them in a diversified portfolio of assets. When an investor joins a PIE, they declare their Prescribed Investor Rate (PIR), which is based on their recent income levels.

The PIE calculates and pays tax on the investor’s behalf at this rate, which is often lower than their marginal tax rate. PIEs can invest in various assets like shares, bonds, and property, spreading risk across multiple investments.

They regularly value their assets and allocate returns to investors proportionally. PIEs must meet specific criteria, including limits on investor ownership and influence over investment decisions.

They report to the Inland Revenue Department and provide investors with annual tax statements. This structure aims to simplify tax obligations for investors while potentially offering tax advantages compared to direct investing.

Investment Process

The basic operation of a PIE involves:

- Investors contributing funds to the PIE

- Professional managers investing these funds across various assets

- Returns being generated through capital gains, dividends, and interest

- Distribution of returns to investors or reinvestment within the PIE

Tax Treatment

PIEs offer unique tax advantages:

- Income is taxed at the investor’s Prescribed Investor Rate (PIR)

- PIR is capped at 28%, which can be lower than an investor’s marginal tax rate

- Capital gains on New Zealand and Australian shares are generally not taxed

Prescribed Investor Rates (PIR)

Understanding PIRs is crucial for PIE investors:

- PIRs are based on an investor’s income level

- Common rates are 10.5%, 17.5%, and 28%

- Investors are responsible for providing the correct PIR to their PIE

Benefits Of Investing In PIE’s

Investing in Public Interest Entities (PIEs) offers several advantages for investors seeking stable and long-term growth opportunities. PIEs, which typically include large companies such as banks, insurance firms, and publicly traded corporations, are often subject to stricter regulatory oversight and transparency requirements.

This heightened level of governance reduces risks associated with financial mismanagement and enhances investor confidence. Additionally, PIEs are usually well-established organizations with significant market influence, providing investors with a chance to invest in robust and often dividend-paying entities.

These investments can also contribute to the broader economy by supporting entities that are vital to public welfare and econo

Tax Efficiency

PIEs offer several tax benefits:

- Potential for lower overall tax on investment income

- No tax on capital gains for most domestic equity investments

- Simplified tax reporting for investors

Professional Management

Investors in PIEs benefit from:

- Expertise of professional fund managers

- Access to a wide range of investment opportunities

- Ongoing monitoring and adjustment of the portfolio

Diversification

PIE’s provide:

- Exposure to a broad range of assets

- Risk mitigation through diversification

- Access to investments that might be difficult for individual investors to acquire

Convenience And Accessibility

Investing in PIEs offers:

- Easy entry and exit options

- Regular reporting and performance updates

- Potential for lower minimum investment amounts compared to direct investing

Tailored Investment Options

PIEs can cater to various investor needs:

- Conservative to aggressive risk profiles

- Sector-specific or geographically focused funds

- Income-oriented or growth-oriented strategie

Read This Blog: Why Should Georgia Invest Into Different Airport Locations?

Risks And Considerations

When investing in any financial instrument or sector, it’s essential to be aware of the risks and considerations involved. Market volatility, economic downturns, and changes in regulatory environments can all impact the performance of investments.

Additionally, industry-specific risks, such as technological disruption or shifts in consumer behavior, can affect the stability and profitability of companies. Investors should also consider the potential for ethical dilemmas, especially in sectors with environmental or social implications.

Proper risk assessment, diversification, and staying informed about market trends are crucial strategies for mitigating these risks and making informed investment decisions.

Market Risk

Like all investments, PIEs are subject to market fluctuations:

- Value of investments can go up or down

- No guarantee of returns

- Importance of matching risk profile to investment strategy

Fees And Expenses

Investors should be aware of:

- Management fees charged by the PIE

- Potential performance fees

- Transaction costs within the fund

Liquidity Considerations

Depending on the PIE structure:

- Some PIEs may have restrictions on withdrawals

- Listed PIEs may be subject to market liquidity

- Potential for suspension of withdrawals in extreme market conditions

Tax Implications

While PIEs offer tax benefits, there are considerations:

- Importance of providing the correct PIR

- Potential for tax adjustments if incorrect PIR is used

- Tax treatment of foreign investments within the PIE

Performance Variability

Investors should understand:

- Past performance does not guarantee future results

- Different PIEs can have vastly different performance outcomes

- Importance of regular review and rebalancing

Regulatory Framework

The regulatory framework refers to the set of rules, laws, and guidelines established by government agencies and regulatory bodies to oversee and govern industries and markets.

This framework ensures that businesses operate within legal boundaries, maintain fair practices, and protect the interests of consumers, investors, and the public. For investors, understanding the regulatory environment is crucial as it affects everything from compliance costs to market stability.

A strong regulatory framework can enhance transparency, reduce risk, and build investor confidence, while changes or uncertainties in regulations can introduce new risks and require careful consideration in investment strategies.

New Zealand Legislation

PIE’s operate under specific regulations:

- Income Tax Act 2007

- Financial Markets Conduct Act 2013

- Various guidelines issued by the Financial Markets Authority (FMA)

Compliance Requirements

PIEs must adhere to strict compliance standards:

- Regular reporting to investors and regulatory bodies

- Maintaining eligibility criteria as a PIE

- Proper calculation and attribution of taxable income to investors

Investor Protection Measures

Regulatory framework includes:

- Disclosure requirements for PIE managers

- Segregation of investor assets

- Independent custody of investments

Comparison With Other Investment Vehicles

When comparing investment vehicles, it’s important to consider factors like risk, return potential, liquidity, and time horizon. Traditional investment options such as stocks, bonds, and mutual funds offer varying levels of risk and return, with stocks generally providing higher growth potential but also greater volatility.

Bonds, on the other hand, are considered safer but usually offer lower returns. Real estate investments provide tangible assets and potential for steady income but can be less liquid.

Meanwhile, emerging vehicles like ETFs and cryptocurrencies offer unique opportunities and risks, with ETFs providing diversification at lower costs and cryptocurrencies offering high risk and reward in a rapidly evolving market.

Each vehicle has its own set of advantages and drawbacks, and choosing the right one depends on the investor’s goals, risk tolerance, and market outlook.

PIEs vs. Direct Investing

Comparing PIEs to direct investment in stocks or bonds:

- PIEs offer professional management and diversification

- Direct investing provides more control but requires more expertise and time

PIE’s vs. Traditional Mutual Funds

How PIEs differ from conventional mutual funds:

- Tax treatment is the primary differentiator

- PIEs may offer more tailored investment options for NZ investors

PIEs vs. Exchange Traded Funds (ETFs)

Comparing PIE’s to ETF’s:

- ETFs often have lower fees but may not offer the same tax benefits

- PIEs can provide more actively managed strategies

Read This Blog: Are Automatic Investments A Money Skill?

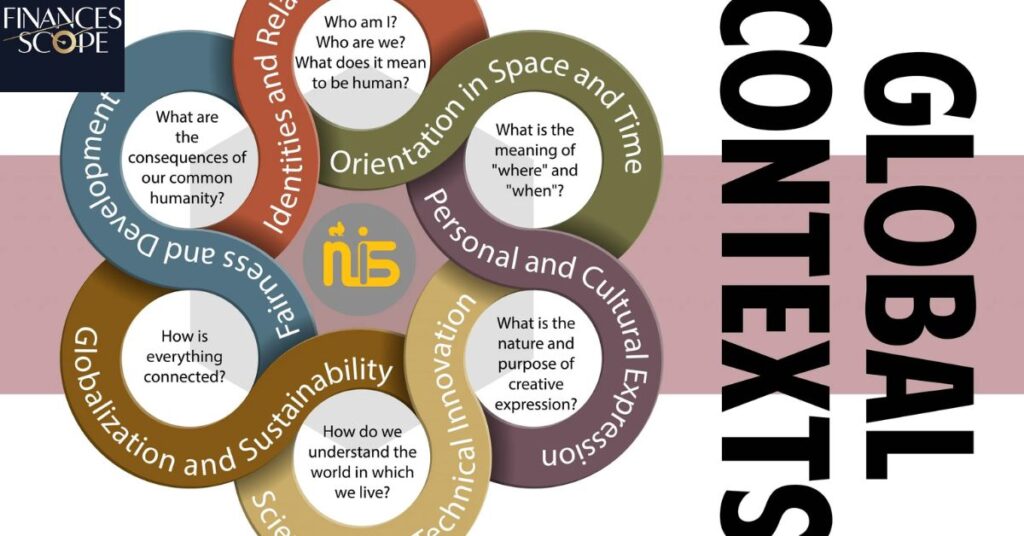

PIE’s In The Global Context

Public Interest Entities (PIEs) play a critical role in the global economy, encompassing large-scale organizations like multinational corporations, financial institutions, and publicly traded companies that have significant influence on economic stability and public welfare.

The global presence of PIEs often means they must navigate complex international regulations and standards, such as IFRS (International Financial Reporting Standards), which can impact their operations and financial reporting.

For investors, PIEs represent opportunities to invest in entities with significant market influence and regulatory oversight, but they also require careful consideration of geopolitical risks, currency fluctuations, and compliance with diverse regulatory environments across different regions.

International Equivalents

Similar structures in other countries:

- U.S. Mutual Funds and Exchange Traded Funds (ETFs)

- UK Unit Trusts and Open-Ended Investment Companies (OEICs)

- Australian Managed Investment Trusts (MITs)

Global Investment Opportunities through PIEs

How PIEs facilitate international investment:

- Access to global markets through PIE structures

- Currency hedging options within PIEs

- Simplified tax treatment of foreign investments for NZ investors

Cross-Border Considerations

Issues to consider for international investors:

- Tax treaties and their impact on PIE investments

- Reporting requirements for foreign investors in PIEs

- Currency risk in international PIE investments

Choosing The Right PIE

Selecting the right Public Interest Entity (PIE) for investment requires a thorough analysis of several key factors. Investors should consider the financial health and stability of the PIE, including its revenue streams, profitability, and debt levels.

It’s also important to evaluate the company’s market position, competitive advantages, and growth potential within its industry. Regulatory compliance, corporate governance, and transparency are crucial aspects, as PIEs are held to higher standards of accountability.

Additionally, understanding the geopolitical and economic environments in which the PIE operates can provide insights into potential risks and opportunities.

Finally, aligning the investment with your personal financial goals, risk tolerance, and ethical considerations will help in choosing a PIE that fits your portfolio strategy.

Assessing Your Investment Goals

Factors to consider:

- Short-term vs. long-term investment horizon

- Income needs vs. capital growth objectives

- Risk tolerance and capacity

Evaluating PIE Performance

Key metrics to examine:

- Historical returns (while understanding their limitations)

- Risk-adjusted performance measures

- Consistency of performance over different market cycles

Understanding Fee Structures

Important fee considerations:

- Management expense ratio (MER)

- Performance fees, if applicable

- Entry and exit fees

Reviewing The Investment Strategy

Aspects to analyze:

- Asset allocation and diversification approach

- Active vs. passive management style

- Alignment with your investment philosophy

Due Diligence On PIE Managers

Factors to investigate:

- Track record and experience of the management team

- Stability and reputation of the investment firm

- Transparency in communication and reporting

Future Of PIE’s

The future of Public Interest Entities (PIEs) is likely to be shaped by evolving regulatory landscapes, technological advancements, and growing expectations for corporate responsibility.

As global markets become increasingly interconnected, PIEs will need to adapt to stringent international regulations and standards, ensuring transparency and accountability across borders.

Technological innovations, such as AI and blockchain, are expected to revolutionize how PIEs operate, offering new opportunities for efficiency but also introducing new risks that will need to be managed .

There is a growing emphasis on sustainability and ESG (Environmental, Social, and Governance) criteria, with stakeholders demanding that PIEs play a more active role in addressing global challenges like climate change and social inequality.

PIEs that successfully navigate these trends while maintaining strong financial performance and ethical standards are likely to remain influential and attractive to investors in the years to come.

Technological Advancements

Potential impacts of technology on PIEs:

- Increased use of robo-advisors for PIE selection and management

- Enhanced reporting and real-time performance tracking

- Integration with personal financial management tools

Regulatory Evolution

Possible changes in the regulatory landscape:

- Potential adjustments to PIR structures

- Enhanced disclosure requirements

- Integration with global tax reporting standards

Market Trends

Emerging trends in the PIE market:

- Growing interest in sustainable and ethical investment PIEs

- Development of more specialized and niche PIE offerings

- Increased competition leading to fee compression

Economic Factors

How economic shifts might affect PIE’s:

- Impact of interest rate changes on PIE strategies

- Adaptation to changing global economic landscapes

- Response to major economic events or crises

Frequently Asked Questions

What is the main advantage of investing in a PIE?

The primary benefit is tax efficiency, with investment income taxed at the investor’s Prescribed Investor Rate, which is often lower than their marginal tax rate.

Can non-New Zealand residents invest in PIEs?

Yes, non-residents can invest in PIEs, but they are subject to different tax rules and should seek specific advice.

How often can I change my PIR?

You can change your PIR at any time by notifying your PIE provider, but it’s crucial to ensure it’s correct to avoid tax issues.

Are all PIEs actively managed?

No, while many PIEs are actively managed, there are also passively managed PIEs that track market indices.

What happens if I invest in a PIE with the wrong PIR?

If you provide an incorrect (lower) PIR, you may need to pay additional tax. If the PIR is too high, you may be able to claim a refund.

Conclusion

Portfolio Investment Entities (PIEs) represent a significant innovation in the New Zealand investment landscape, offering investors a tax-efficient and professionally managed avenue for growing their wealth.

By providing a structure that combines the benefits of diversification, professional management, and favorable tax treatment, PIEs have become an attractive option for a wide range of investors.

The key advantages of PIEs, including their tax efficiency, professional management, and diversification benefits, make them a compelling choice for many investors.

Like all investment vehicles, PIEs come with their own set of risks and considerations. Investors must carefully evaluate their personal financial goals, risk tolerance, and investment horizon when considering PIE investments.

Marcus Delgado is a certified financial planner with expertise in retirement strategies and tax optimization.

With a background in economics and a passion for helping individuals achieve financial freedom, Marcus provides practical advice on long-term wealth building and smart money management.