Interning in the investment industry can be an exciting and rewarding experience for those looking to kickstart their careers in finance.

It offers a unique opportunity to gain hands-on experience build a professional network and potentially secure a full-time position in a competitive field.

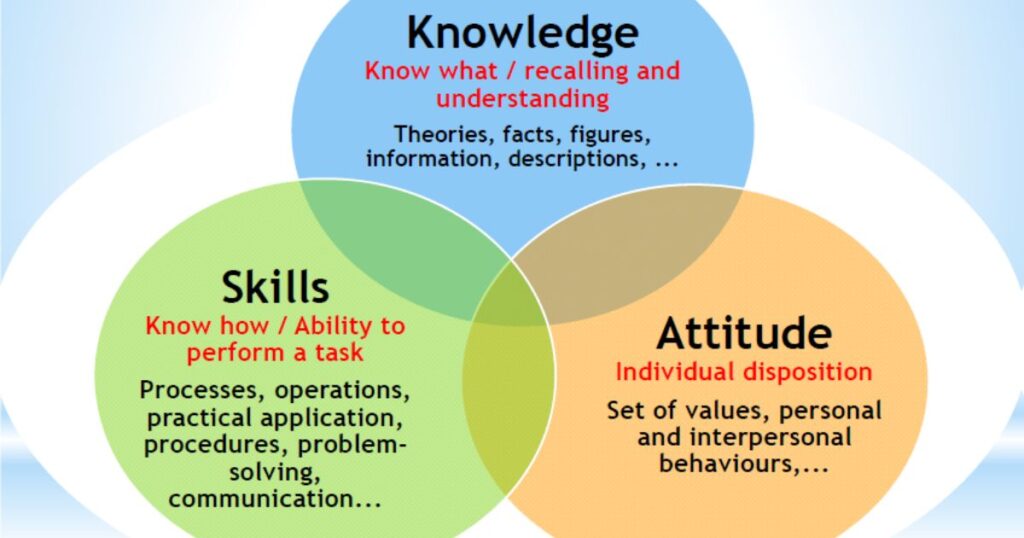

The world of investing can be complex and demanding requiring specific knowledge skills and attitudes to succeed.

This article aims to provide aspiring interns with essential information and insights to help them prepare for and make the most of their internship experience in the investment sector.

Understanding The Investment Landscape

Before embarking on an internship, it’s crucial to understand the various types of investment firms:

Types of Investment Firms

- Investment Banks

- Asset Management Companies

- Hedge Funds

- Private Equity Firms

- Venture Capital Firms

- Robo-Advisors and FinTech Companies

Key Market Participants

Familiarize yourself with the roles of different market participants:

- Institutional Investors

- Retail Investors

- Brokers and Dealers

- Regulators (e.g. SEC, FINRA)

- Exchanges (e.g. NYSE, NASDAQ)

Asset Classes And Investment Vehicles

Gain a basic understanding of various asset classes and investment vehicles:

- Stocks

- Bonds

- Mutual Funds

- Exchange-Traded Funds (ETFs)

- Derivatives (Options, Futures)

- Real Estate Investment Trusts (REITs)

- Cryptocurrencies and Digital Assets

Essential Skills And Knowledge

Entering an internship requires a strong foundation of essential skills and knowledge relevant to the industry.

These include both hard skills, such as technical proficiency or sector-specific expertise, and soft skills like communication, teamwork, and problem-solving.

Equipping yourself with these competencies is crucial for making a positive impact and gaining valuable experience during your internship.

Technical Skills

Develop proficiency in the following areas:

- Financial Modeling

- Data Analysis

- Valuation Techniques

- Risk Management

- Portfolio Theory

Software and Tools

Familiarize yourself with common software and tools used in the industry:

- Microsoft Excel and VBA

- Bloomberg Terminal

- FactSet

- Capital IQ

- Python or R for data analysis

Financial Concepts

Understand key financial concepts and metrics:

- Time Value of Money

- Discounted Cash Flow (DCF) Analysis

- Financial Ratios (P/E, EV/EBITDA)

- Modern Portfolio Theory

- Capital Asset Pricing Model (CAPM)

Market Knowledge

Stay informed about current market trends and events:

- Read financial news regularly (e.g. Wall Street Journal, Financial Times)

- Follow market indices and major stocks

- Understand economic indicators and their impact on markets

Read This Blog: Can Corporations Claim Business Investment Loss?

Preparing For The Internship

Preparation is key to a successful internship. This involves researching the company, understanding its culture, and familiarizing yourself with the tasks you’ll be expected to perform.

Preparing also includes setting clear goals, organizing your time, and ensuring you have the necessary tools and resources to excel in your role from day one.

Academic Background

Consider pursuing relevant coursework:

- Finance

- Economics

- Accounting

- Statistics

- Computer Science

Certifications And Courses

Look into additional certifications or courses:

- CFA Level I

- Financial Modeling Certifications

- Online courses in specific areas of interest (e.g. Python for Finance)

Networking

Build your professional network:

- Attend career fairs and industry events

- Join finance clubs or organizations at your school

- Connect with alumni working in the investment industry

- Utilize LinkedIn to make professional connections

Resume And Cover Letter

Craft a strong resume and cover letter:

- Highlight relevant coursework, projects, and experiences

- Emphasize quantitative skills and analytical abilities

- Tailor your application to the specific firm and role

The Internship Experience

The internship experience offers a unique opportunity to apply academic knowledge in a real-world setting. It’s a chance to work alongside professionals, learn industry practices, and gain practical insights.

This hands-on experience is invaluable for developing your career, building a professional network, and refining your career aspirations.

Common Roles And Responsibilities

Be prepared for various tasks and responsibilities:

- Conducting financial research and analysis

- Assisting with financial modeling and valuation

- Preparing presentations and reports

- Supporting senior team members in client meetings

- Participating in investment committee discussions

Work Environment

Understand the typical work environment:

- Fast-paced and high-pressure atmosphere

- Long working hours, including potential weekends

- Formal dress code (often business professional)

- Hierarchical structure with clear reporting lines

Learning Opportunities

Take advantage of learning opportunities:

- Attend training sessions and workshops

- Participate in lunch-and-learn events

- Seek mentorship from experienced professionals

- Ask questions and show genuine interest in learning

Networking During The Internship

Continue to build your network throughout the internship:

- Connect with fellow interns

- Engage with professionals from different departments

- Attend company social events and outings

- Schedule informational interviews with team members

Ethical Considerations And Compliance

During an internship, understanding and adhering to ethical standards and compliance guidelines is essential.

This includes respecting confidentiality, following company policies, and maintaining professionalism at all times.

Being aware of these considerations helps ensure a respectful and productive working environment, while also safeguarding your professional reputation.

Regulatory Environment

Familiarize yourself with key regulations:

- Securities Act of 1933 and Securities Exchange Act of 1934

- Investment Advisers Act of 1940

- Dodd-Frank Wall Street Reform and Consumer Protection Act

Ethical Standards

Understand and adhere to ethical standards:

- CFA Institute Code of Ethics and Standards of Professional Conduct

- Firm-specific ethical guidelines and policies

- Importance of integrity and professionalism in the industry

Compliance Procedures

Be aware of compliance requirements:

- Know your customer (KYC) and anti-money laundering (AML) procedures

- Insider trading regulations

- Personal trading restrictions and reporting requirements

Confidentiality And Data Protection

Respect confidentiality and data protection rules:

- Handle sensitive information with care

- Adhere to data protection policies and procedures

- Understand the consequences of breaching confidentiality

Read This Blog: What Are The Good Investments For Global Warming?

Maximizing Your Internship Experience

To maximize your internship experience, take a proactive approach by seeking out learning opportunities, asking questions, and engaging with mentors and colleagues.

Show initiative in your tasks and be open to feedback. By fully immersing yourself in the experience, you can gain deeper insights, develop your skills, and make meaningful contributions to your team.

Setting Goals

Establish clear goals for your internship:

- Identify specific skills you want to develop

- Set learning objectives for each week or month

- Discuss your goals with your supervisor or mentor

Seeking Feedback

Actively seek feedback to improve your performance:

- Schedule regular check-ins with your supervisor

- Ask for specific feedback on your work and areas for improvement

- Be open to constructive criticism and use it to grow

Taking Initiative

Show initiative and enthusiasm:

- Volunteer for additional projects or responsibilities

- Propose ideas or solutions when appropriate

- Complete tasks thoroughly and ahead of deadline when possible

Building Relationships

Focus on building lasting professional relationships:

- Be respectful and professional with all colleagues

- Show appreciation for those who help or mentor you

- Maintain connections after the internship ends

Challenges And How To Overcome Them

Internships can come with challenges such as adjusting to a new work environment, managing time effectively, or dealing with complex tasks.

Overcoming these challenges involves staying adaptable, seeking support when needed, and maintaining a positive attitude.

Approaching obstacles as learning opportunities can help you grow both personally and professionally.

7. Post-Internship Considerations

Information Overload

Deal with the vast amount of information:

- Develop a system for organizing and prioritizing information

- Take thorough notes during meetings and training sessions

- Don’t be afraid to ask for clarification when needed

Time Management

Manage your time effectively:

- Prioritize tasks based on importance and urgency

- Use tools like calendars and to-do lists to stay organized

- Learn to estimate task durations accurately

Imposter Syndrome

Combat feelings of inadequacy:

- Remember that you’re there to learn

- Focus on your growth and progress throughout the internship

- Seek support from mentors or fellow interns when feeling overwhelmed

Work-Life Balance

Maintain a healthy work-life balance:

- Set boundaries and learn to manage stress

- Make time for self-care and relaxation

- Communicate with your supervisor if workload becomes unmanageable

Post-Internship Considerations

After completing an internship, it’s important to reflect on your experience and consider the next steps in your career.

This might include updating your resume, seeking feedback from supervisors, and evaluating how the skills and knowledge you’ve gained align with your future goals.

Staying in touch with your professional contacts and continuing to build on your experiences can also open doors for future opportunities.

Evaluating Your Experience

Reflect on your internship experience:

- Assess what you learned and how you’ve grown

- Identify areas where you’d like to gain more experience

- Consider how the experience aligns with your career goals

Securing a Full-Time Offer

Position yourself for a full-time offer:

- Express your interest in a full-time role if applicable

- Ask about the evaluation process and timeline

- Maintain contact with key team members after the internship ends

Leveraging Your Experience

Use your internship experience to advance your career:

- Update your resume and LinkedIn profile

- Prepare stories and examples for future interviews

- Consider how the experience might inform your future career choices

Continuing Education

Plan for ongoing learning and development:

- Consider pursuing advanced degrees (e.g. MBA, MSF)

- Look into professional certifications (e.g. CFA, CAIA)

- Stay informed about industry trends and technological advancements

Frequently Asked Questions

What skills are most important for an investing internship?

Key skills include financial modeling, data analysis attention to detail and strong communication abilities. Proficiency in Excel and an understanding of financial markets are also crucial.

How competitive are investing internships?

Investing internships, especially at top firms, are highly competitive. Strong academic performance, relevant experience and networking can improve your chances of securing an internship.

What should I wear to an investing internship?

Most investment firms maintain a business professional dress code. Men typically wear suits, while women wear suits or appropriate dresses with blazers. Always check with your specific employer for dress code guidelines.

How can I stand out during my investing internship?

To stand out, demonstrate a strong work ethic, show initiative, ask thoughtful questions and consistently deliver high-quality work. Building positive relationships with colleagues and showing genuine interest in the industry are also important.

What are the typical working hours for an investing intern?

Working hours can be long and variable, often exceeding 40 hours per week. Investment banking interns, in particular, may work 60-80 hours or more per week, including some weekends.

Conclusion

Embarking on an internship in the investment industry can be a transformative experience that sets the foundation for a successful career in finance. By understanding the landscape, developing essential skills and preparing thoroughly, aspiring interns can position themselves for success.

The internship itself offers invaluable opportunities to gain hands-on experience, build a professional network and potentially secure a full-time position in this competitive field.

It’s important to approach the internship with realistic expectations and a willingness to work hard and learn. The investment industry can be demanding, with long hours and high-pressure situations.

Interns should be prepared to face challenges from information overload to time management issues and develop strategies to overcome these obstacles.

Marcus Delgado is a certified financial planner with expertise in retirement strategies and tax optimization.

With a background in economics and a passion for helping individuals achieve financial freedom, Marcus provides practical advice on long-term wealth building and smart money management.